Hi Guys,

It’s always interesting when two subscribers enquire about a relatively small local company, even if it is in a space we spend little time:

Starpharma (SPL) is a $174mn biotech company specialising in dendrimer-based technology for pharmaceutical applications. Its products include:

- VivaGel BV, a non-antibiotic vaginal gel for bacterial vaginosis.

- VRALEZE, an antiviral nasal spray that uses its dendrimer platform.

The company also develops its DEP (Dendrimer Enhanced Product) drug-delivery platform for oncology—such as DEP-SN38, DEP-cabazitaxel and DEP-docetaxel, all in clinical trials, hence success hinges on trial outcomes, regulatory approvals and commercialisation.

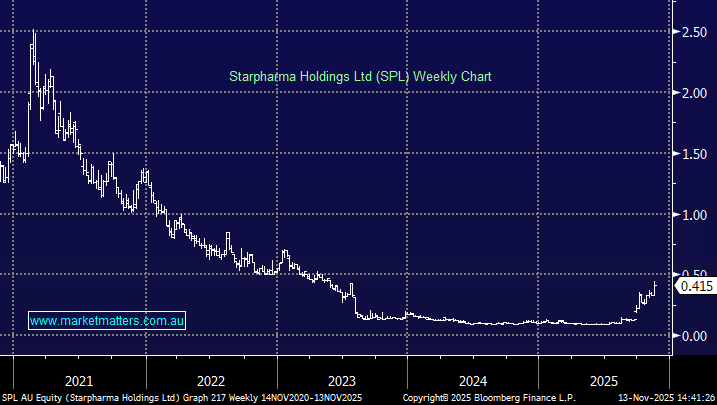

The share price over recent years illustrates why we rarely venture into the specialised space and would always advocate using stops in stocks that can halve in the blink of an eye. However, SPL has started to look interesting of late having secured a $5.5mn upfront payment from Genetech as part of a collaboration and exclusive licensing agreement. The deal represents a significant validation of Starpharma’s DEP platform and sets up a potentially large revenue stream — though the bulk of value lies in future milestones and royalties, not immediate sales.

- We like SPL as an aggressive play while it can hold above 33c, a big stop but attractive risk/reward.

NB Unlike DRO directors have been buying SPL shares!

Actinogen Medical (ACW) is a $156mn Sydney based company focused on developing treatments for neurological and neuro-psychiatric diseases by targeting brain cortisol levels.

Last month the company received a handy $5.5mn R&D tax incentive considering it already had a decent cash-runway for a biotech of its size: in 2025 reported to have $23mn in cash and burn of $8.7mn pa, giving ~2.6 years of runway without accounting for new financing. Plus, this week ACW delivered a positive ASX announcement that it had received positive recommendation from first Data Monitoring Committee meeting to continue Alzheimer’s phase 2b/3 trial without amendment.

If its lead drug Xanamem succeeds in major trials and gets commercialised, there’s significant upside; but until then, it’s speculative and dependent on upcoming clinical, regulatory and financing milestones.

- We like ACW as a very aggressive play while it can hold above 3.4c, a big stop but attractive risk/reward.

NB – Biotechs are not an area we feel comfortable in – too many binary outcomes in our view.