Hi Michael,

Youve taken us off-piste a touch here, but the recent performance of ERD looks a bit like the topical DroneShield (DRO) illustrating how the small-cap space can deliver great returns, but it comes with significant risk. Hence, we often overlay technicals at the small end of town to mitigate risk:

Artrya (AYA) – this $590mn medical-technology company based in Perth, specialises in AI-driven diagnostic imaging for coronary artery disease. Its flagship product is the Salix platform, which uses AI to automatically analyse coronary-computed-tomography-angiography (CCTA) scans to detect high-risk plaque, assess blood-flow, and stratify patients at risk of heart-attack events.

The stock has surged 7x from its 2025 low in ~5 months helped by the company securing its first US commercial customer, Tanner Health, in the September quarter, leading to its first US revenue, they also raised cash to give them a robust balance sheet:

- AYA has initiated its U.S. commercial launch, signing a five-year agreement with U.S. hospital group Tanner and targeting a large addressable market of CCTA scans (~400,000 scans/year) in partner systems.

- They also completed a $80 million capital raise at $2.05 to fund this U.S. expansion and commercialisation phase, which also reduced immediate funding risk.

AYA looks poised to trade back above $4 into Christmas but chasing strength feels fraught with danger as high valuation/growth stocks keep getting re-rated down across the local market, hence we’re neutral at present although we do like the story.

Scidev (SDV) – this $95mn environmental solutions company focuses on water-intensive industries such as mining, oil & gas has popped ~50% over the last 2 weeks but it’s still trading significantly below where it was this time last year. The stocks taken off this month after winning a ~$20mn contract for the NT rehabilitation Project. The contract covers the design and construction of a multi-stage groundwater treatment plant to treat contaminated water from legacy uranium mining at the former Rum Jungle Mine.

- We like SDV while it can hold above 37c, an initial ~30% upside wouldn’t surprise.

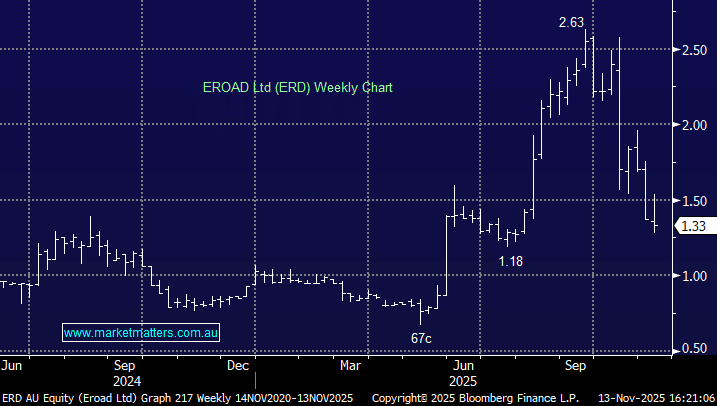

EROAD (ERD) – the $55mn small-cap looked good early last month when it was trading ~$2.25 but it got hammered on the 17th after flagging a NZ$150mn impairment due to challenges in the North American market which led to a downgrade to FY26 revenue guidance. Not what high-valued small-caps need when the markets looking for growth

- ERD feels all too hard to us now.