Hi Paul,

ARU is a is a $920mn rare earths business which as you say is backed by Gina Rheinhart. There main asset is the Nolans Project, a fully integrated “ore-to-oxide” rare earth operation focused on neodymium and praseodymium (NdPr). In the midst of the recent share price appreciation, ARU raised a substantial $475mn at 28c for its Northern Territory project – it will also receive $100mn from the Australian government and is being considered to receive $300mn of financing from the US Export-Import Bank.

The miner is targeting first production in 2028–2029 and with the company now well-funded things are on track although there’s a lot of water to go under the bridge before they start to enjoy rare earth revenue, hence the speculative nature of the stock, but it’s an interesting “punt” in a sector that feels likely to enjoy another run sometime in the coming months/years.

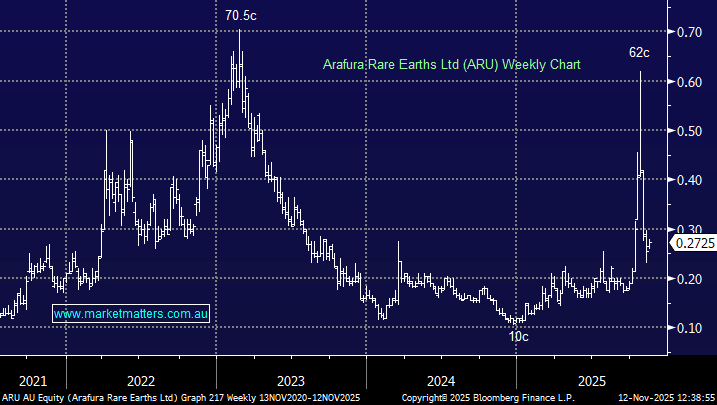

- We like ARU for a “specie” around 25c, although given the large equity raise at 28c, we expect some resistance at that level.