Hi Lambertus,

RIO’s Simandou is ~7.5% of seaborne supply and ~5.4% total supply, yet iron ore prices have remained robust ahead of the mine’s first shipments, supported by a mix of tighter supply — including declining Indian net exports and low Chinese port inventories — plus stronger-than-expected demand from Southeast Asia and India. Factors such as uneconomic Chinese scrap and resilient Chinese direct and indirect steel exports have also contributed to a more sanguine price outlook. It’s important to note, that Simandou’ s supply is largely already priced in, with analysts’ models already reflecting its impact.

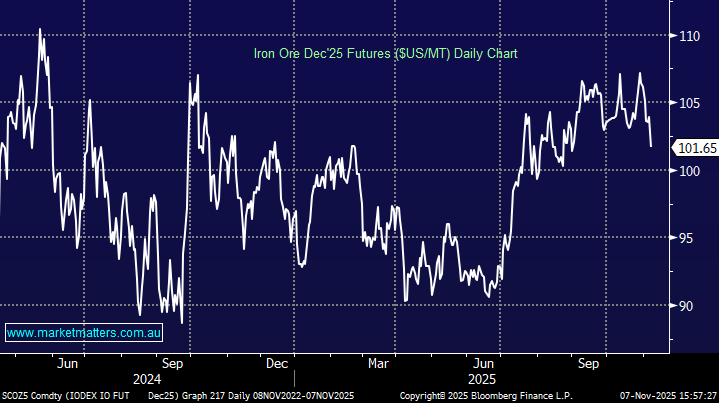

- We estimate that if iron ore price averages $US100Mt in the coming years, then analyst’s will be hiking there average valuations across BHP, RIO, FMG, MIN by~ by at least 10%, all else equal.

We remain bullish on iron ore stocks heading into 2026, believing that analysts are overly focused on a bearish outlook driven by anticipated supply increases—but markets rarely move as simply as the models suggest.

Carma (CMA) is a new ASX that listing we’re not across in detail. Its a Sydney based online auto retailer that is hoping to emulate US car retailer Carvana, whose shares have risen nearly 55% this year.

The stock only has a $330mn market cap and as you say is trading down ~11% from its listing price. The reason for the fall after being an oversubscribed IPO was a negative note from JP Morgan raising concerns around unit economics and scalability, cash burn rate and valuation – a bad trifecta for listing day! Maybe some sour grapes as they were not on the ticket!