Amazon’s cloud unit posted the strongest growth rate in almost three years, reassuring investors who were concerned that the largest seller of rented computing power was losing ground to rivals. Amazon Web Services posted revenue of $US33 billion, +20% YoY and the biggest year-over-year rise since the end of 2022 – expectations were for ~18% growth, though they had been flagging constraints in getting new data centres online, which prompted some in the market to question their ability to keep growing at such high rates.

- 3Q Revenue $US180.17bn, +13% YoY, above $US177.82 estimates.

- 3Q EPS $1.95v $1.68 QoQ, above $1.58 estimates.

- Subscription services net sales of $US12.57bn, up +11% YoY, above $US12.49bn estimates.

- Amazon Web Services net sales excluding FX, +20% vs. +19% YoY, above the estimated +17.9%.

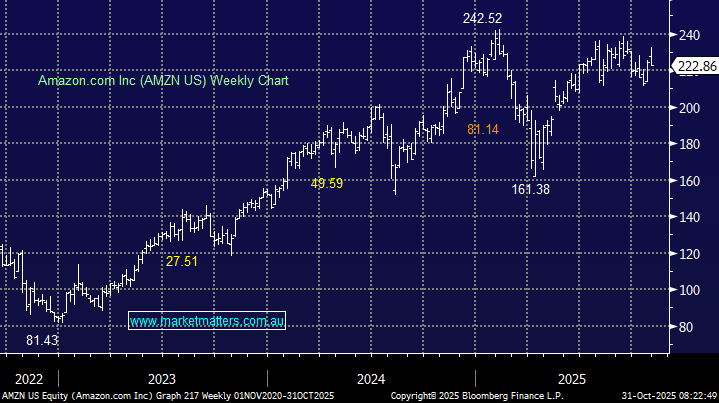

AMZN continues to see strong demand in AI and core infrastructure and with sales topping estimates and execution towards the AI evolution on track, AMZN looks good into 2026. Shares jumped ~13% in afterhours trading, having lagged peers this year.