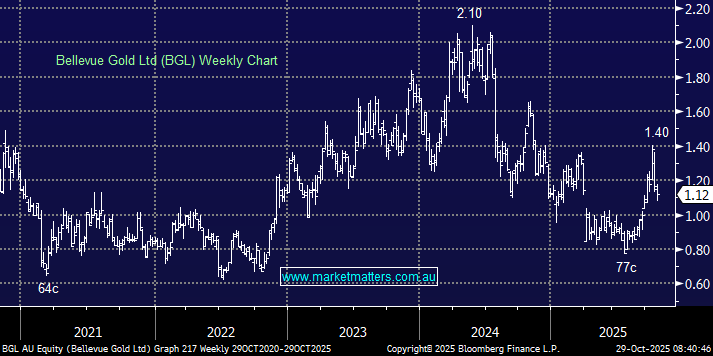

During one of the most bullish periods for gold prices in decades, BGL shares have fallen ~30% over the past 12-months – a diabolical performance considering the extreme tailwinds. They certainly haven’t enjoyed an easy transition from explorer to producer, having flicked the switch into commercial production early in 2024. Operational hiccups, dilution and a gold hedgebook struck well below spot prices has left the share price materially lagging peers at a time when the gold price is not far off all-time highs.

- That chequered track record is the key reason ~$1.6bn BGL continues to screen extremely cheap relative to peers, and we now ponder whether the future could be brighter.

Putting production issues to one side, a lot of their problems stemmed from an aggressive hedging strategy that locked them in to selling gold at prices materially below spot during a time of rising costs. While they raised equity to reduce some of the liability, they still have 142.5koz hedged at ~A$2,857/oz out to March 2028 – a painful undiscounted $382–485m drag depending on your gold price assumptions, but it does become less relevant as production rises.

In terms of production, the September quarter produced 29.1koz, reflecting a development-heavy period with lower grades (2.8g/t) through the Deakin orebody. Importantly, that work sets BGL up for improving grades through FY26, and we believe near-term guidance is credible. With head grades expected to step above 4.5g/t, we believe FY26 production should comfortably meet guidance of 130–150koz. From FY27, the runway to 175–195koz looks likely if Deakin and Deakin North deliver reserve-grade ore consistently (~5g/t).

There have also been issues with their processing plant; however, this bottleneck now looks to have eased, having just demonstrated throughput above 1.18mtpa – just shy of the ~1.35 Mtpa nameplate capacity from the stage 1 expansion. The bigger risk is grade and mining execution. The plant will only perform if the mined feed is consistent and high-grade. They had planned a stage 2 expansion (to 1.6 Mtpa); however, this has been put on ice while they focus on operational stability first, a pragmatic move in our opinion.

Further, balance sheet concerns have eased following April’s $156m equity raise at 85c/share, leaving cash and bullion of ~$156m against $100m of debt due in 2027. Near-term free cash flow is earmarked to chip away at the hedge book and de-risk the balance sheet.

The real upside remains exploration. Once development opens more drilling platforms late FY26 and into FY27, the company can return focus to reserve growth and mine life extensions — critical to attracting buyers back to the story.

- Valuation also looks attractive. On spot prices, BGL is worth ~$2 a share. UBS reckon the current equity is pricing gold closer to US$3,350/oz.

That said, the equity risk premium should be high, given their woeful track record across pretty much all aspects of the operation. That can change though, and quickly, if execution improves and they start to live up to expectations.

- Bellevue has disappointed investors many times over, we’re not blind to that. But at current levels, the stock offers leverage to near record gold prices with a pathway to material production uplift already funded and visible. Execution remains key, but we see a beaten-up producer with genuine self-help, rising grades and upside through exploration.