HUB delivered another outstanding quarterly update yesterday, reaffirming its status as one of the highest-quality structural growth stories on the ASX. Platform net inflows jumped to $5.16 billion in the September quarter, up +28% on the same period last year, driving Funds Under Administration (FUA) to a record $146.5 billion.

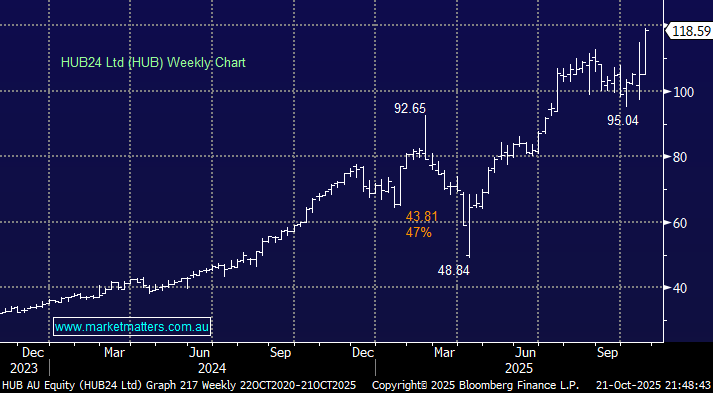

- The market liked what it saw — shares rallied more than 10% on Tuesday, trading to a new all-time high, as investors continue to reward HUB’s consistent execution and scalability.

While broader market sentiment has been uneven, HUB’s inflow momentum remains top of class. The company’s $5.16 billion quarterly inflow represents an annualised flow rate approaching $20 billion, evidence of the platform’s strong adviser engagement and growing penetration of the independent advice market.

Importantly, HUB’s inflows continue to outpace market growth by a wide margin, reflecting continued migration from legacy institutional platforms as advisers consolidate toward independent, tech-enabled solutions. While our adjacent portfolio/wealth management brand Market Partners leverages Praemium technology, given its targeted capability in reporting and administration of directly held assets (rather than funds), the success of HUB is hard to ignore

At the same time last year, HUB had $113b on the platform, with yesterday’s result representing YoY growth of +29%. Importantly, HUB is growing faster than peers such as Netwealth and Praemium. Platform businesses rely on scale, with greater scale driving operating leverage and margin expansion.

HUB’s success continues to rest on three structural pillars:

- Technology leadership – HUB’s platform remains the benchmark for functionality, integration, and efficiency, enabling advisers to run model portfolios, client reporting, and execution seamlessly.

- Service quality – Adviser satisfaction scores remain industry-leading, underpinning retention and referrals.

- Scalable economics – The business is capturing operational leverage as FUA grows, with margins improving despite ongoing reinvestment in innovation.

Their revenue mix is strong, spanning custody, data, and investment administration, which provides resilience through market cycles.

- HUB24 remains one of our preferred medium-term growth exposures, combining a long runway for market-share gains with strong earnings visibility and capital efficiency.

While the valuation is rich after the recent rally, we believe the growth trajectory justifies a premium. With record inflows, expanding margins, and an increasingly entrenched adviser network, HUB remains a core holding in the Market Matters Active Growth Portfolio.