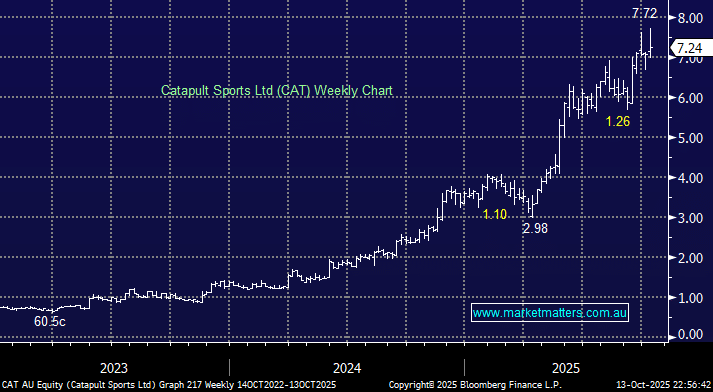

We have been long CAT in our Emerging Companies Portfolio since 2023, with the position currently up more than +400%, and it’s a business we continue to like, although it’s evolved from an illiquid small cap to a widely held and discussed global growth stock. The $2bn company has now entered the ASX200, making it an option for our Active Growth Portfolio, and on cue, the company announced a $130mn capital raise to fund the purchase of soccer analytics firm IMPECT GMBH for Euro78mn.

CAT announced that it planned to raise the money via institutional placement at $6.68, a 7.7% discount to Friday’s close. The company also released its preliminary 1H results and reaffirmed guidance of Annual Contract Value growth (ACV) to remain strong with low churn. We like the deal to acquire IMPECT; it’s a strategic fit that further enhances the company’s portfolio while providing the foundation to expand into a broader range of sports. The CAT acquisition shows the road map forward, plugging in additional capabilities into their dominant platform in sports analytics.

We discussed CAT in depth last month here, with valuation now our only concern, especially above $7, where index buyers appeared to have pushed the stock as it entered the main board. In essence, we continue to like the structural story, but we’re conscious that the multiple leaves little room for error – particularly in a market where investors have been quick to punish any wobble in growth expectations.

- We have a large weighting in the Emerging Companies Portfolio, and we are closer to a trim for this holding, but we’re likely to only sell into strength. In terms of its inclusion in the Growth Portfolio, this would only come onto our radar into a deeper pullback towards ~$6 – which seems unlikely for now.