Hi David,

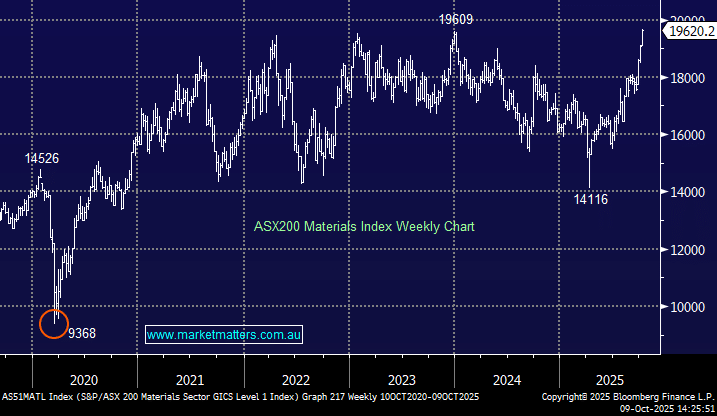

Firstly, great news! As of Thursday, over the last three months the Materials Sector has surged almost 22% while the ASX200 has only gained ~5% hence you’ve been in the right place at the right time. We’re also very happy with recent portfolio performance, however, as you rightly ask what we are thinking now. A lot comes down to timeframes;

- We remain bullish the copper, gold, iron ore and uranium stocks but a ~5% pullback wouldn’t surprise – it’s been hot and we think the run is maturing in the short term.

When things run really hot, as they have, we are generally keen to take some off the top, but we remain committed to our positive view on commodities over the medium term. We think there is a growing dynamic building where overall supply will fall short of demand, which is ultimately bullish for prices. This is a medium term view, so we will are more likely to retain core holdings in the likes of BHP, SFR, PDN and MIN. It also comes down to overall portfolio positioing. The Active Growth Portfolio for example is running with higher cash ~(12.5%) hence we are more net buyers than sellers. If we were fully invested with a more significant skew to resources, we would likely lighten the load – particularly in Gold in the short term.