Hi Trish,

Two different strategies from BetaShares with HYLD the relatively new market offering:

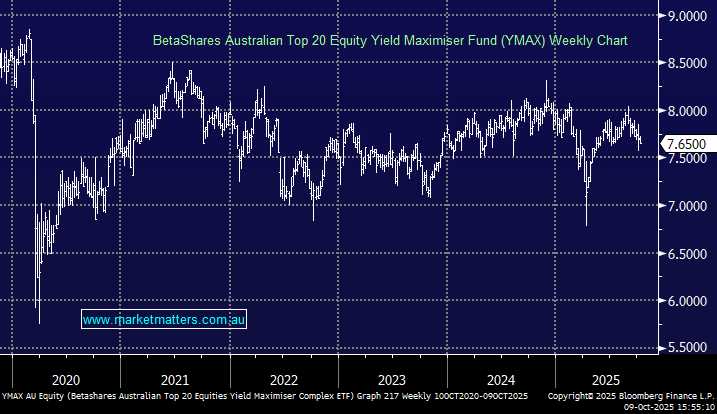

BetaShares Australian Top20 Equities Yield Maximiser Complex ETF (YMAX) is a mixture of ASX20 stocks, however, it also writes call options on each – the cost is 0.69% pa.

- This ETF has returned +10.6% over the last 3-years, ahead of its benchmarks +9.4%.

- The main three allocations are 44.6% banks, 15.2% miners and 6.4% retail.

- This fund will likely perform better in a declining market, or a market that tracks sideways, and will likely underperform HYLD in a strong bull market.

BetaShares Australian S&P Australian Shares High Yield ETF (HYLD) is a mixture of 50 ASX200 companies with high forecast dividend yields – cost is lower at 0.25% pa.

- This ETF has returned +0.35% over the last month, not a long track record!

- The main three allocations are 39.7% banks, 14.2% miners and 6.9% insurance.

We like both of the ETFs being long term believers in the stock market but with the ASX and valuations around all-time highs we think here and now the YMAX has a better outlook.