Hi Bernie,

Thanks for the feedback, much appreciated!

For subscribers not familiar with VRI, it’s a $130mn software company specialising in extended reality (XR) and AI solutions for industries like defence, manufacturing, and retail, offering products that enable immersive 3D visualization and digital collaboration. While it has growing recurring revenue streams, our number have them still making a small loss due R&D expense – but it’s not a company we know well.

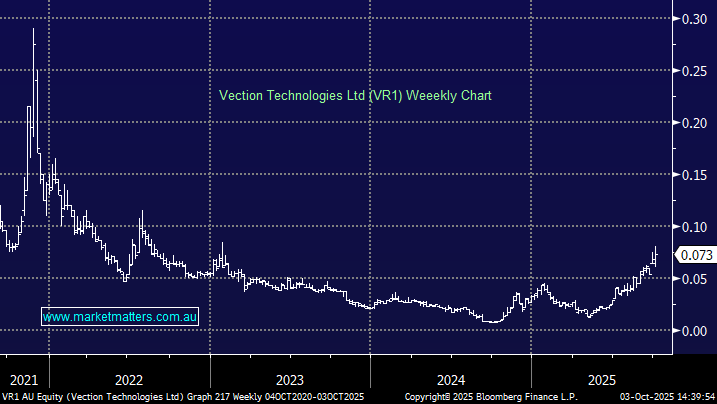

They have secured some decent contract wins in 2025 which has helped its share price increase from 3c to over 7c:

- Last month VR1 announced its largest contract to date, valued at $22.3 million, with a NATO-approved customer.

- In June VR1 secured a $4.4 million repeat order from a top 10 global defence contractor.

- In July VR1 announced new Algho AI agreements worth $1mn with $0.5mn from a 3rd contract with Area 12 Consulting S.R.L., bringing their partnership’s cumulative value to 3.6mn in just ten weeks.

This is obviously a “speccie” but its winning meaningful contracts and looks an interesting aggressive investment ~7c. In terms of value, a stocks worth is determined by the present value of future cash flows, so having the ability to forecast future cash flows is therefore very important. In the case of VR1, this seems a tough ask with any degree of certainty, which makes valueing a company like this, very difficult. In reality, it’s more a case of getting comfortable with the ability of management to execute on their stated plans.