Thanks for the thanks Adel, always appreciated.

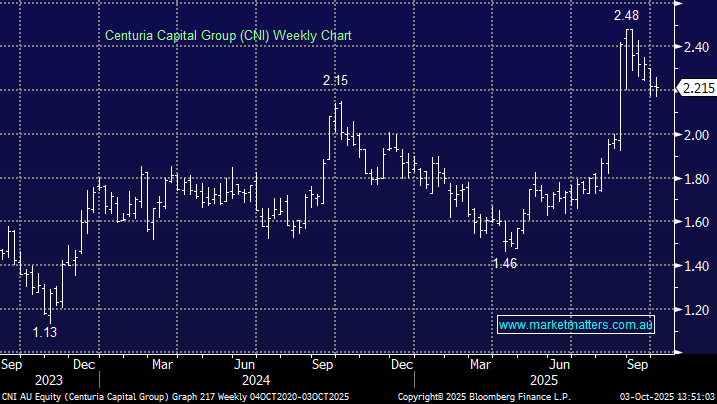

We still hold CNI in our Active Income & Emerging Companies Portfolio’s having liked their FY25 result in August. The stocks slipped back to almost pre-result levels as optimism towards RBA rate cuts through the remainder of 2025 and into 2026 fade away. The company was upbeat at their results, and on the call with management, they seemed to be flagging a real change of ‘vibe’ moving from preservation mode, back into growth mode. The brokers are still Sell rated on the stock, but we disagree.

If, like they say, they can start growing FUM again, we think the markets negative positioning will prove wrong. This is where the best share price gains happen, when outcomes are ‘not consensus’.

We think the pullback in the share price is creating an opportunity to gain exposure into a company that enjoys steady fees from a growing AUM base while it rotates out of mature assets into the themes of tomorrow, like real estate credit (via Centuria Bass), and AI/data infrastructure (ResetData).

- We remain long and bullish CNI looking for its yield to grow steadily over the coming years.