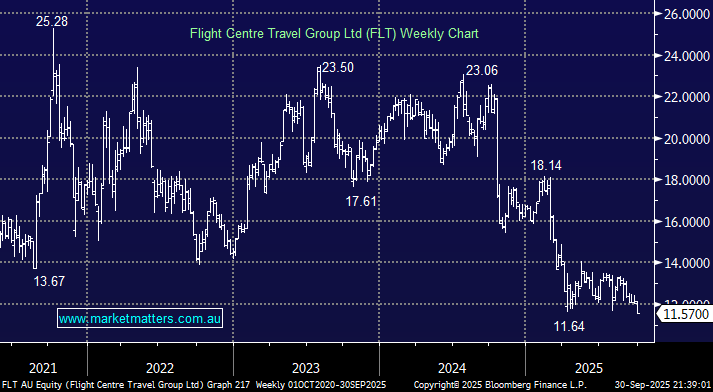

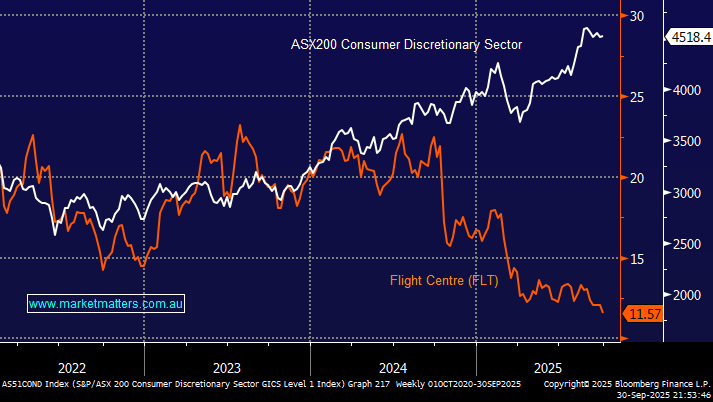

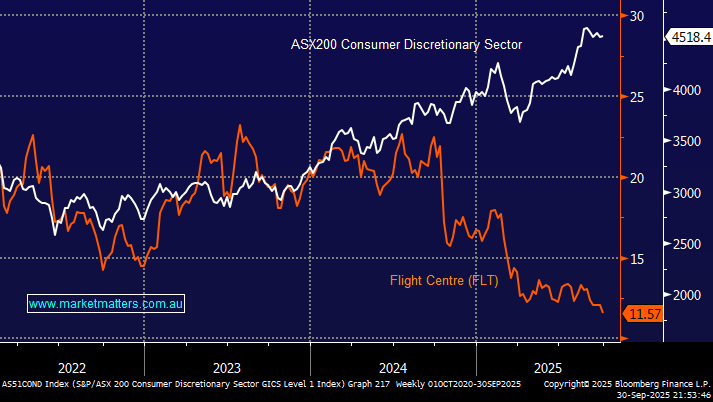

Tuesday saw FLT make fresh 12-months lows with Web Travel Group (WEB) not too far behind, while Corporate Travel (CTD) has been in suspense for over a month because of accounting irregularities causing delays in releasing its FY25 financial results. The large-cap Australian travel stocks look and feel a mess at the moment, with FLT the worst in 2025, falling over 30% year-to-date. The perplexing fact, on first glance, is why the ASX travel stocks have struggled while the retail stocks have largely boomed; they’re both chasing the same consumer dollars.

Interestingly, the picture is almost reversed in the US, with travel stocks having generally outperformed, led by strong gains in cruise lines, online travel agencies, and hotel operators as consumer demand for travel rebounds. Conversely, retail stocks have shown mixed results, with e-commerce and essential-goods players like Amazon and Walmart performing well, while traditional brick-and-mortar retailers struggle. Overall, travel benefits from renewed discretionary spending, whereas retail performance was increasingly split between resilient online/essential segments and weaker physical stores. This raises the question about whether FLT is a bricks-and-mortar business evolving into an e-commerce player, or one being left behind.

FLT has cited that a tougher global environment, with cautious consumers and geopolitical uncertainties (such as U.S. policy shifts and Middle East tensions), is weighing on travel demand, particularly for routes to and through the U.S. and parts of Asia. These are cyclical issues, although it’s hard to foresee when things will improve. In response to these challenges, FLT has implemented cost-control measures, including a hiring freeze and reduced capital expenditure, while investing in new growth areas such as a leisure loyalty program and integrating artificial intelligence into customer service.

- While the exact percentage remains undisclosed, FLT’s strategic focus on digital transformation and online services suggests a growing contribution from online sales to its overall revenue.

Operationally, FLT has enjoyed a slow but steady increase in revenue from $2.3bn to $2.8bn over the last three years, not exciting growth numbers, but not ones that would point to a share price halving. FY25 delivered profit (NPAT) of a $212.6mn, reflecting a 3% decline compared to the previous year, but with the company’s balance sheet not in need of repair, the stock is feeling like a turnaround story, in need of a catalyst – dangerous terrain over recent years.

FLT makes its money from 2 distinct areas:

- The corporate division, encompassing brands like FCM Travel and Corporate Traveller, which achieved a record TTV of $12.3bn in FY25, marking a 2% year-on-year increase.

- The leisure segment, which includes retail storefronts, online brands, and luxury travel services, more the face of FLT that we see day to day.

Corporate travel will continue to be its primary revenue driver, particularly as the sector is viewed as a non-discretionary expense by businesses – even after Covid! In terms of their leisure business, FLT is investing heavily in digital and loyalty programs to entice and retain customers, but it’s a competitive area, and they’re clearly behind the 8-ball.

FLT is cheap, trading on an Est. PE of 11.3x for FY26 and is forecast to yield 3.5% fully franked. Being cheap is not enough though, and its business model is certainly not exciting, which shows in their inability to benefit from healthy consumer spending. With the local sector in the doldrums and further rate cut hopes fading, we see no reason to catch this falling knife for now.

- At this stage, we need a catalyst to adopt a more bullish stance towards FLT, with margins being the key metric to watch.