The materials sector has been the standout performer over recent months, with tailwinds on the macro and stock level:

- The influential copper, gold and iron commodities have all been strong, to extremely strong in recent months.

- Corporate activity has gathered momentum with Anglo American and Teck Resources announcing a “merger of equals” a few weeks ago.

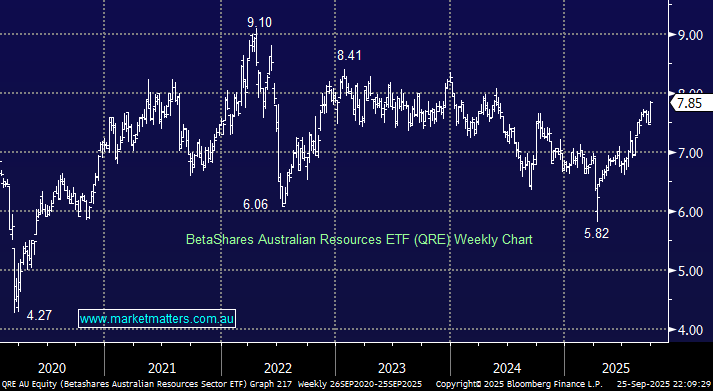

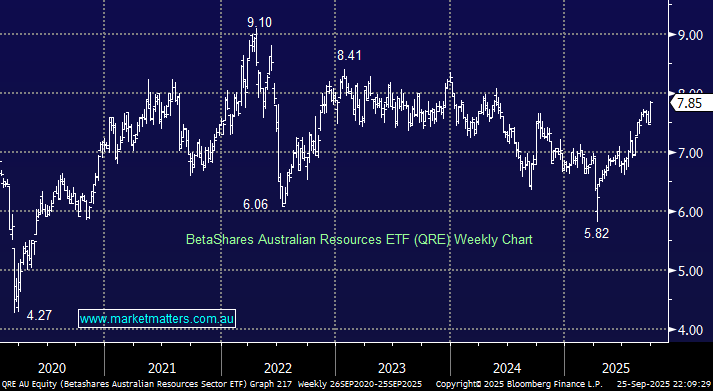

The strong recovery by the local miners has been reflected in the BetaShares Australian Resources ETF (QRE), which has rallied 35% after a lacklustre few years. This ETF is dominated by a 40% holding in BHP & RIO, while high-flying gold stocks have more than offset the weakness in Woodside and Santos, which currently makes up around 11% of the Solactive Australian Resources index the ETF tracks. A few months ago we wrote, “We are bullish on the QRE and initially target a test/break of $8, or 15% higher.” In hindsight, we now believe this was too conservative, and another 5-10% upside into Christmas wouldn’t surprise.

- We can see the QRE ETF testing the $9 in 2026, or 15% higher.