GGP is a $4.9bn gold and copper mining company focusing in the Western Australian Paterson region. It owns the Telfer gold-copper mine and the nearby Havieron project, with a combined resource base of over 10 million ounces of gold and almost 390,000 tonnes of copper. The company is building production scale by integrating Havieron with Telfer’s existing infrastructure while continuing regional exploration.

The stock has rallied ~50% from its August low after the company became profitable following its Telfer acquisition from Newmont. Last month, the WA miner reported a pretax profit for FY25 of $422.9mn after losing $28.5mn in FY24; the set of numbers saw the stock rally ~15%. The company enjoys no debt and “significant liquidity”; although no dividend has been mentioned at this stage, it, and/or some capital initiatives, look possible moving forward.

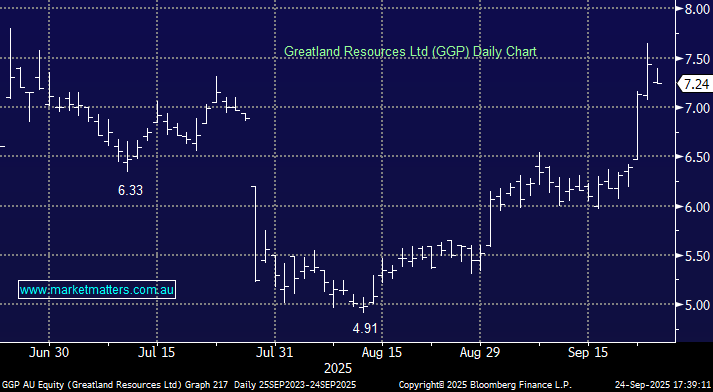

Greatland Resources Ltd was previously known as Greatland Gold plc, before it listed on the ASX In its current structure, in June and after a wobbly start has started to slowly reward investors. The stock plunged in late July after cutting production guidance, pushing up its AISC. One of several local miners to suffer hiccups operationally over the last 12-months, but it remains in the exciting copper and gold space with an attractive underlying deposit.

- We like GGP, but it’s not our pick for copper &/or gold exposure at this stage.