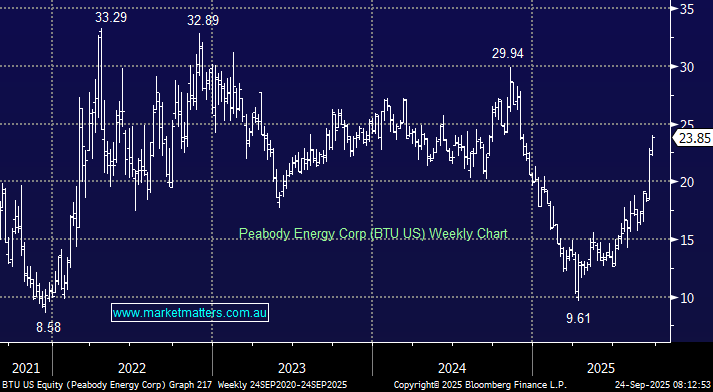

BTU has been on a good run of late, with the share price more than doubling since the April 2025 low, implying that our local coal producers should be performing a little better than they are. For context, Peabody remains one of the world’s leading coal producers with 17 mines across the US and Australia, supplying both thermal coal (for power generation) and metallurgical coal (for steelmaking).

- While coal prices have cooled since the 2021/22 boom, there’s a strong case they’ve found a floor as weaker producers exit the market and Asian demand continues to grow, particularly from India.

In late 2024, Peabody announced a US$3.78b deal to acquire Anglo American’s Queensland coal mines. However, following a methane-related fire at Moranbah North earlier this year, Peabody cited a material adverse change and walked away. Anglo is contesting the claim, and the dispute heads to arbitration. While management is confident in its position, there remains a small risk of damages having to be paid, though we think this is low, and the market seems to agree. Importantly, the failed deal leaves Peabody with balance sheet flexibility and the capacity to accelerate shareholder returns.

Management has pledged to return 65–100% of free cash flow to shareholders, primarily through buybacks. Given current valuations, the math is powerful – if shares trade in the mid-$20s to $30s, repurchases could materially reduce the share count and amplify upside.

The growth driver for BTU is it’s Centurion mine located in the Bowen Basin (QLD), with production scheduled to start in early 2026, with a ramp-up to 4.7Mtpa of premium hard coking coal. Even at conservative assumptions (3Mt at US$185/t), Centurion could deliver something like $US550m in revenue and $150m+ in annual free cash flow post-capex. The timing here is also good, with Indian met coal demand expected to surge from 87Mt to 135Mt by 2030.

Based on these metrics along with their other operations, and factoring in ongoing aggressive buybacks, we think there is a realistic pathway for BTU to trade well north of $US40/sh in the coming years, if they execute well.

That’s the positive – the negative is that thermal coal remains in secular decline, as the world moves towards renewable energy. However, as we’ve written many times over recent years, this will take time, and the lowest cost mining operations, such as Peabody’s Powder River Basin mines, will be the ones that last, and benefit from the progressive closure of higher cost peers.

- There are risks in this space, with coal price volatility, regulatory pressure, and the Anglo arbitration outcome all key variables, but the best way for a company to mitigate these externalities is by having a very strong and cash-rich balance sheet, and a diverse mix of assets, two characteristics clearly evident in BTU.

Peabody is transitioning from a steady cash-flow US thermal operator to a growth-focused met coal player with the startup of Centurion. Coal prices look to have bottomed, and we think the combination of stable base earnings, a new high-margin growth operation, and aggressive buybacks gives it clear upside over the next few years.