Hi Ben,

Great to have you on board – we have a lot of financial advisers that use our service.

TVN is a new stock to MM so we’re not accross it in any depth. Its a $230mn Australian critical minerals developer focused on vanadium, fluorite, and titanium. Its key projects include the Speewah Fluorite & Vanadium Project (WA), the Sandover Project (NT), and the Mount Peake deposit (NT). Also, TVN is advancing its own TIVAN+ processing technology to add downstream value and has partnerships such as with Sumitomo Corporation, plus government grant support.

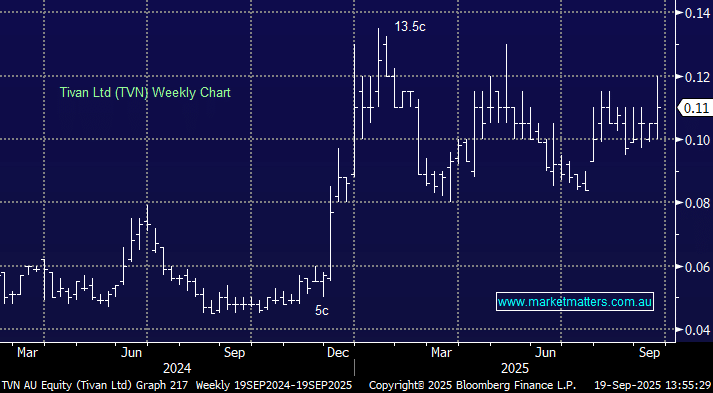

This is a “hot space” at present which has helped TVN double since late November – news is increasing of late with the company clearly looking to expand at this early stage of its evolution:

- This week it bought the FRAM joint venture project from Thor Energy for $8.8mn – it holds Molyhill tungsten, molybdenum and copper.

- It also received firm commitments to raise ~$15mn at 10c, a small discount to the last 10-day average.

The company is still pre-revenue, with its first meaningful income most likely to come from the Speewah Fluorite Project in 2026–2027, pending permitting, funding, and construction. This is a very speculative stock but the risk/reward looks ok close to 10c. Certainly a speccy but in the right space.