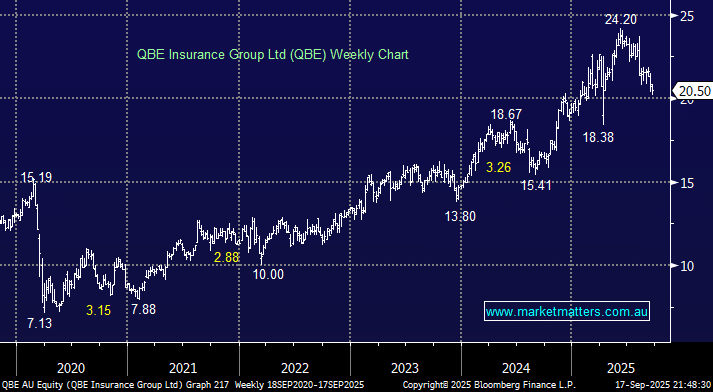

QBE has drifted ~15% lower in recent months as investors structure portfolios around a lower interest rate environment. The stock is trading on a PE of 10.8x relative to peers IAG trading on 18x and Suncorp (SUN) trading on 17x implying a solid relative and absolute valuation in an expensive market, and QBE has been performing strongly as a business.

The insurer’s FY25 result did lead to some small downgrades, but as the price action illustrates nothing of significance. The company lifted its dividend as profit jumped 27% but we feel the stocks drifted lower on profit taking after its strong run, and with ~50% of its revenue coming from North America, Fed rate cuts weigh on profitability – QBE receives income its U.S. cash and premium reserves primarily held in low-risk, liquid fixed-income instruments to ensure funds are available to pay claims while earning a modest return.

- We can see QBE remaining subdued short-term as the market focuses on rate cuts, but value is presenting itself.