CAT has been a very strong performer in 2025, with the share price rallying hard as the market warmed to its improving growth profile, operating leverage and more consistent execution after multiple prior years of disappointment. Trading volumes have increased, putting it on the radar of larger funds, and this has pushed its market cap from around $800m at the time of their 1H25 results, to now above $1.9bn. This has propelled CAT from illiquid small cap, to a now widely held and discussed global growth stock, and the valuation now reflects the extreme change in investor sentiment.

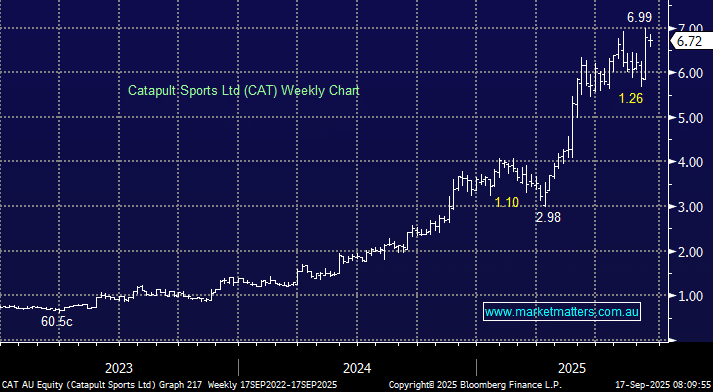

- We’ve owned CAT for 2 years, with our position up 370% in that time. We’re now contemplate trimming the holding.

There are two parts to the CAT business, with wearable sports performance analytics technology the dominate division with an incredibly strong market position, multiples bigger than its nearest rival. They continue to take market share, and their customers are growing in size, sophistication, and financial muscle. Other verticals are being plugged into their platform, with video technology experiencing strong recent success. Revenue momentum remains healthy, margins are trending in the right direction, and the balance sheet is in decent shape.

- The only question now is valuation. Catapult’s share price has tripled over the past 12 months, and our initial target weight of 4% has grown.

From our perspective, CAT has now moved from being a turnaround/value story into something closer to a momentum trade. Valuation is starting to look stretched following the recent rally, with the stock now pricing in a continuation of near-perfect execution.

While we continue to like the structural story and believe management is running the business very well, we’re conscious that the multiple leaves little room for error – particularly in a market where investors are quick to punish any wobble in growth expectations.

- In short, we still like Catapult, but discipline around portfolio management is key. After such a strong run, we’re likely to trim our weighting to lock in gains and recycle capital into more attractively priced opportunities, while still maintaining exposure to the company’s long-term growth potential.