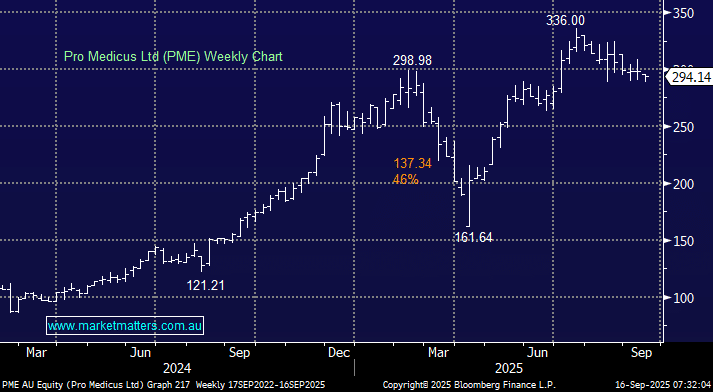

Despite its name this medical imaging software and IT solutions business is far more tech than healthcare to MM. However, it’s in the healthcare sector and does again demonstrate the recent weakness in the space, having retreated over 12% from its July high. We believe there are two topical factors at play here, firstly, PME has struggled of late in line with a weak local healthcare sector. Secondly, in a similar fashion to recent comments on the defence sector, when a stock is trading on a significant valuation, still 195x est. FY26 for PME, it must keep winning new contracts to advance; a quiet period often leads to some profit-taking as we’ve seen with PME of late.

- We like the risk reward towards PME in the $290-295 region, but again, note we don’t regard it as a typical healthcare stock.