Hi Mick,

CSL has been a “hot topic” of conversation over recent weeks since the $100bn biotech disappointed the market with its FY25 result which we discussed in detail here. As we said at the time It’s important to recognise that the numbers weren’t too bad: earnings were up 14%, cash flow grew 29%, and the company announced a $750 million share buyback. However, the market expected more and is now growing wary of CSL’s growth prospects, with scepticism rising amid major financial restructuring.

A couple of important points are worth bearing in mind:

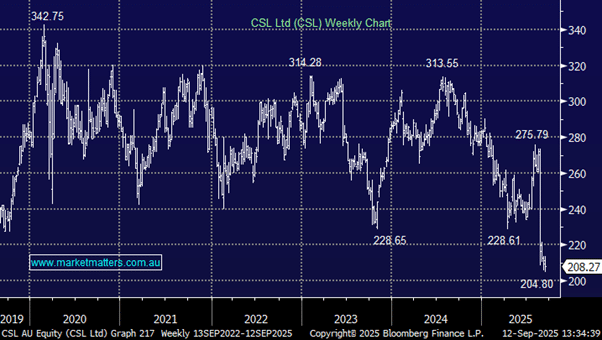

- CSL is now trading more than 40% below its average valuation of the last 5-years.

- We believe CSL will recover but it will take time, as the market digests the major changes the biotech’s undergoing.

- Restructuring breeds uncertainty, something the market is often quick to punish, and CSL must now work to restore confidence in its growth path moving forward.

CSL has been an outperformer of the last decade, leaving many investors holding the stock with a dangerous degree of complacency although it has been choppy since COVID retracing $80-100 on a few occasions over the last few years. However, the stock hasn’t bounced in the last few weeks suggesting to us the selling hasn’t finished hence – we’re in no hurry to increase our exposure.

- We are not considering averaging ~$210 but will be tempted if/when it slips below $200 where the valuation will be compelling to us.