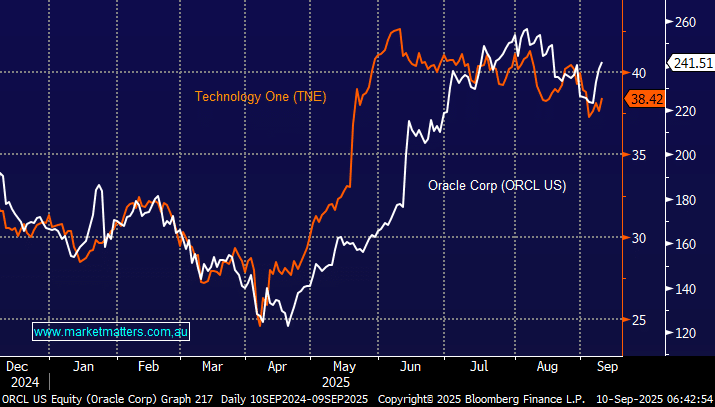

This morning, we revisited TNE following Oracle’s explosive +20% overnight rally in late trade to fresh highs after a huge jump in bookings in the last quarter, following a massive deal with OpenAI. Oracle, known for its database software, has recently found success in the competitive cloud computing market with cloud infrastructure revenue last quarter coming in +55% to a whopping $US3.3bn. TNE and Oracle are very different in scale, but their business models share some DNA, as has been their performance over the last 12 months. The two businesses overlap as below:

- Both sell ERP-style applications (finance, HR, payroll, asset management, student management) designed for large organisations and governments.

- Oracle is shifting customers from on-premise to Oracle Cloud (OCI + SaaS apps), while TNE has already transitioned from on-prem software to a cloud-first SaaS subscription model.

- Both increasingly rely on long-term recurring subscription contracts for stability and growth.

- Both provide consulting, support, and upgrades alongside software, ensuring sticky customer relationships.

At this stage of its evolution, $6bn TNE is like a smaller, focused “Oracle for Australia/NZ,” running a similar SaaS ERP model but without the global cloud and database dominance. TNE is also expanding strongly overseas, with its UK SaaS+ platform now implemented by more than 50 local councils and delivering 50% growth in annual recurring revenue (ARR). It also operates across multiple international markets, including New Zealand, Asia, and Europe, as part of its broader global strategy. The US goliath’s success is offering a degree of insight to TNE for successful expansion.

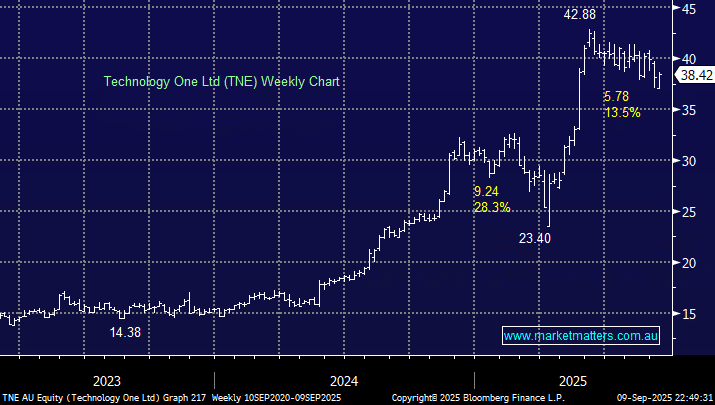

TNE last reported in May posted a very strong 1H25 and upgraded profit guidance for FY25. The business looks to be on the right track to achieve management’s target of $1 billion in recurring revenue by FY30. Two parallel success stories so far this year:

- Both Oracle and Technology One appear to be in the right place at the right time, aided by both companies benefiting from AI as they make their enterprise software smarter and more efficient.

- Oracle is pushing AI on a global cloud scale, while Technology One is applying it more narrowly to government and education SaaS customers in the early days of the AI revolution.

TNE last reported in May and posted a very strong 1H25 and upgraded profit guidance for FY25. The business looks to be on the right track to achieve management’s target of $1 billion in recurring revenue by FY30, but after rallying over +20% so far in 2025, the question is around valuation and how much of this growth is built into the share price – after Oracle’s result this morning, valuation concerns may have dissipated for many investors. A lot of money has been forsaken on valuation grounds this year, which, in many cases, is justified, as share prices rose on PE expansion instead of actual growth, but TNE is different; it’s delivering real growth.

- We like TNE as a business and its expanding global footprint, the risk/reward looks good as it drifts lower, even though we are conscious that the market has lofty expectations ahead of its November result.