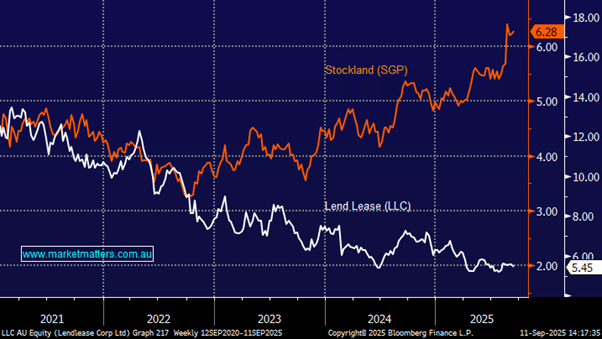

Lendlease (LLC) vs Stockland (SGP) moving forward

Hi, I was wondering if you could provide some comment on the Lendlease vs Stockland as far as valuation and future business would look like. Forgetting the past regarding Lendlease and look at it as a company restructured that owns property as well as develops Australian property. At a high level this is similar to Stockland (but with different property development and ownership) but the valuation is significantly lower. For example LLC is 15% discount to NTA SGP is about 50% premium. Frank