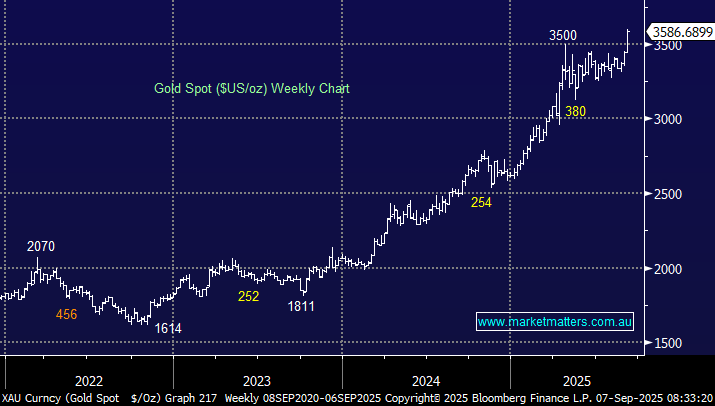

Gold is enjoying a historic rally, surging above $3,500 an ounce after climbing in eight of the past nine trading sessions. The metal is up almost 40% in 2025, its strongest annual performance since 1978, fuelling massive inflows into gold ETFs, including $11.3 billion into SPDR Gold Shares (GLD) and $6.6 billion into iShares Gold Trust (IAU). The boom echoes 1978’s 132% surge, when inflation and a weakening dollar cemented gold’s role as a hedge against monetary instability. The future outlook hinges on U.S. politics, Fed credibility, and global demand. Goldman Sachs sees gold at $US4,000 by mid-2026, with a potential path to $US5,000 if investors shift even a fraction of Treasury holdings into bullion. Continued central bank buying, geopolitical tensions, and trade disruptions could add fuel, while firmer growth, higher real yields, or restored confidence in U.S. monetary policy could sap momentum.

- Our view is a touch contrarian in the short term and we wouldn’t be surprised to see gold fail on its first attempt to power through $US3600/oz.