Hi David,

Predicating a US recession and its subsequent time to recovery is a tough ask, just look at the statistics:

- Since World War II, there have been 12 U.S. recessions, with gaps between them ranging from 1 year to over 10 years.

- The longest US recession over this time was 18 months between 2007 and 2009 when the GFC wiped ~58% off the S&P 500.

- The market then took ~4 years to regain all of the losses and post a fresh all-time high.

At MM we are long term stock market bulls and the numbers over the decades support this with recessions providing valuable buying opportunities for investors prepared to invest when the crowd are looking for the exits. However, adopting a defensive stance into a recession can add significant value to a portfolio making it easier from a psychological perspective to accumulate into weakness when the market will look and feel “wrong” while the bears will be banging their drums in the press.

- A defensive portfolio will be overweight stocks from the utilities, consumer staples, and telcos plus cash/fixed income products.

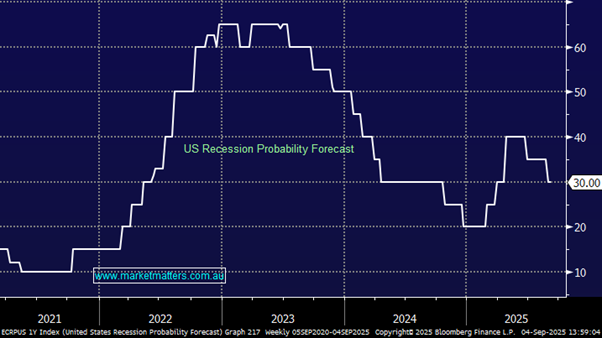

Note the markets only factoring in a 30% chance of a US recession at the moment.