Australian-based hotel technology company SDR provides cloud-based software to help hotels and other accommodation providers manage and grow their bookings. The stock bears some similarities to CSL and JHX, having halved from its late 2024 high before recovering around half of the losses since April. Also, it generates ~30%% of its revenue in the US, which isn’t helping at present.

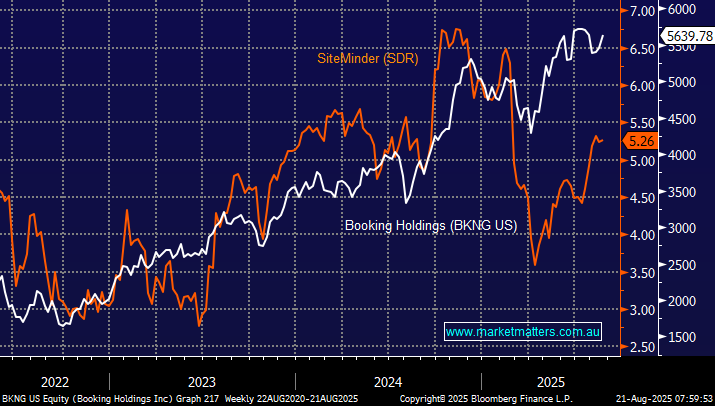

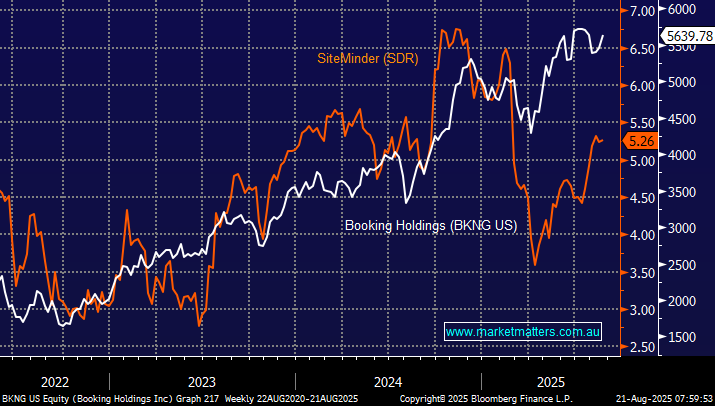

Global travel trends are strong. In July, Booking Holdings posted 32% earnings growth, 13% higher bookings, and margins ahead of expectations, highlighting resilient demand despite macro uncertainty – its stock is up around 250% in recent years. This bodes well for SiteMinder (SDR), whose revenues are tied to room night demand, though softness in the U.S. remains a headwind offset by strength in Asia and Europe. With confidence building globally and potential Fed rate cuts ahead, travel-exposed names like SDR stand to benefit. While SDR isn’t yet profitable, it’s scaling well and reminds us of XRO in its infancy. The stock may look and feel like the two landmines that have exploded this week, but we believe the balance of probability is good for SDR.

- We can see SDR surprising on the upside next Friday: we own SDR in our Emerging Companies Portfolio.