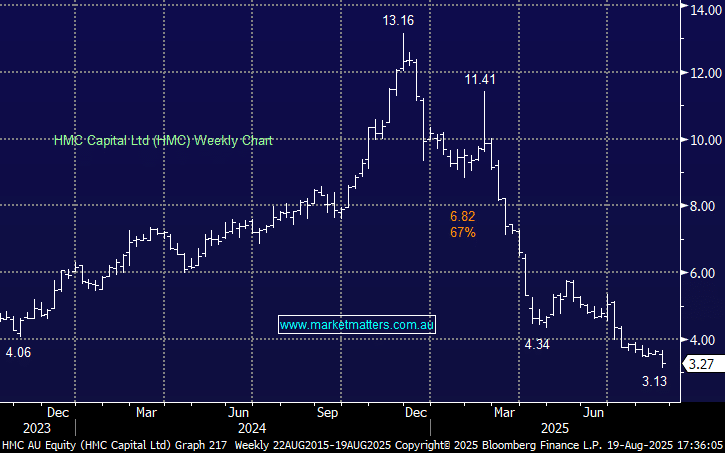

HMC –6.57%: delivered a decent FY25 result, with operating revenue nearly doubling year-on-year, though the market quickly shifted focus to the disappointing guidance for FY26.

- FY25 net income $147.3 million vs $66 million y/y

- Final dividend: A$0.06/share (flat y/y)

- Full-year dividend: A$0.12/share (in line with forecasts)

Looking ahead, HMC has guided to pre-tax operating EPS of ‘at least $0.40’ which is somewhat disappointing given EPS has declined from 56c in FY24 – the softer growth outlook due to private equity returns and transaction volumes normalizing after a bumper year prior.

The disappointing result yesterday for their DigiCo Infrastructure (DGT) -13% didn’t kick things off well, and the outlook here has added further uncertainty, though given the share price fall, we think most of the bad news is priced in here, so we’ll remain patient.