We wrote the following after TTD reported quarterly results last week; All inline for the 2Q, and guidance for 3Q was also smack on consensus, seeing likely revenue of at least $717million relative to consensus of $716.2 million, and adjusted Ebitda about $277 million, estimate $275.7 million. They did announce a change of CFO, which the market never likes, and they are known for ‘beats’ and ‘bumps‘; while they beat mildly, there was no bump to guidance. Still, hard to see why the stock is down so much after hours.

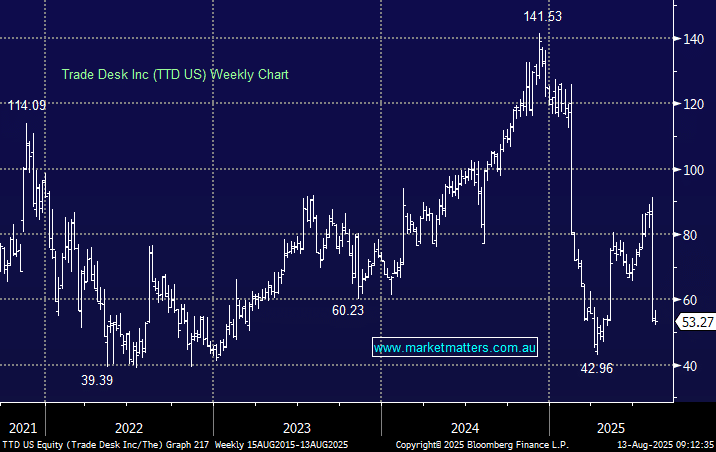

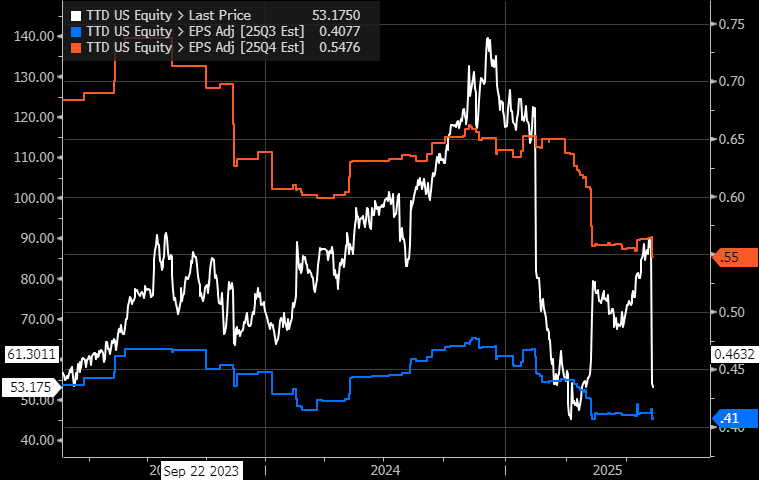

The stock has fallen ~40% since, pretty much losing the gains that it made prior to reporting. This is, and always has been, a very volatile stock; however, there is a noticeable change in sentiment here with the underlying reason being decelerating growth, even though the overall ad market looks strong. The central concern for analysts is the improvements Amazon has made to its demand-side platform, where advertisers buy ad space designed to reach relevant online audiences, eating away at TTD’s competitive position. On the post result call, CEO Jeff Green quickly dismissed the threat from Amazon, which concerns us and others. Sentiment, as measured by the ratio of buy, hold, and sell ratings, has dropped to its lowest in more than two years.

- The below chart looks at analyst earnings revisions (EPS) over time, and the trend is moving lower. In a market that is more heavily influenced by momentum in terms of both earnings expectations and share price, a growth stock that is now seeing consistently lower earnings revisions is not a good sign.

We’ve held a core position in TTD US since 2020, amending weightings along the way, and while we’re still up ~25%, the move has eroded plenty of our open profit. On 28x Est earnings, which are still growing at ~15% annually, TTD US is now clearly in the naughty corner, with investors concerned that its business model may be broken.

- For now, we’ll hold, but unless we get some additional evidence that growth is re-accelerating, we may well move on.