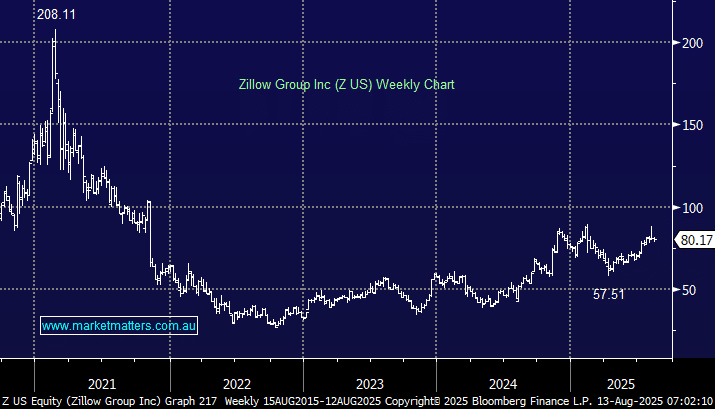

ZG US reported its 2Q results on Thursday (7th August) that were mildly ahead of consensus expectations, and guidance was inline for 3Q revenue, and broadly in line in terms of earnings. The stock initially traded higher, before pulling back in the few sessions since.

- Revenue up 13% y/y to $655 million, beat consensus of $647.4 million

- Adjusted EPS 40c, estimate 39c

- Adjusted Ebitda up 13.8% y/y to $155 million, estimate $152.5 million

They see 3Q revenue at $663-673 million ($666.6 million consensus) with underlying earnings (Ebitda) of $150-160 million ($160.2 million consensus). Digesting the result since it was released, this was another strong period of growth for the property platform despite the market in the US “bumbling along the bottom” as one analyst put it. Their average monthly unique visitors to site was strong at 243 million, with a total of 2.6 billion visits, confirming that their execution remains on point. For the FY, they expect low to mid-teens revenue growth, with continued margin expansion.

The key with a real-estate platform business is its ability to create a technology-driven moat that essentially forces both advertisers and buyers to participate on the platform. REA locally is an excellent example of this, where there is almost a disdain from agents that they have to use REA, and the same is true in the US, albeit it is a more competitive market than our own, but with significantly more eyeballs to tap into.

- The conundrum with Zillow is valuation, trading on an EV/Ebitda multiple of 25x, however, until someone proves to us that they can meaningfully intrude on Zillow’s growing position, or that Zillow’s growth momentum is likely to slow, we will continue to see Zillow as a long-term winner in the space.