Hi Paul,

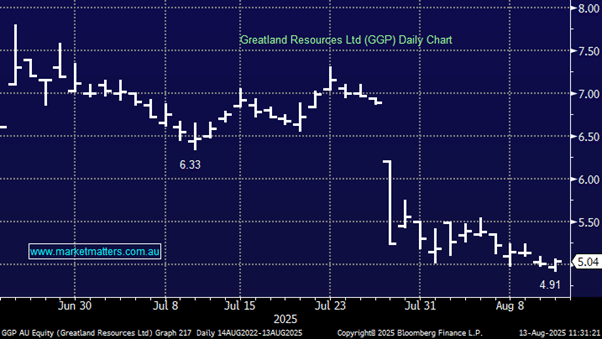

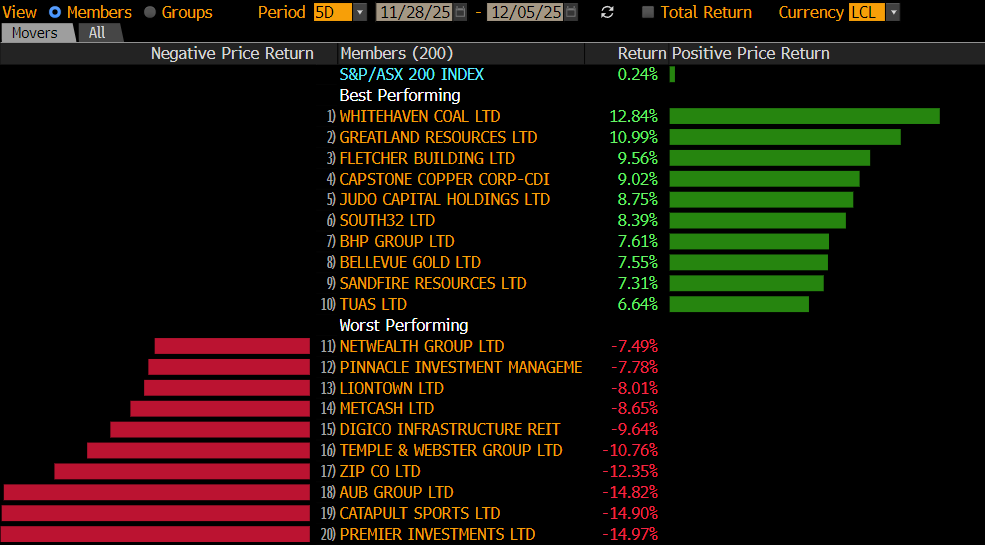

For subscribers not familiar with this new copper/gold miner, Greatland Resources Ltd (GGP) floated at $6.60, well above its current ~$5 level. Its not been off to a good start, in late July the stock collapsed by over 25%, following the company lowering its full-year gold output forecast to 260,000–310,000 ounces, down from the previously expected 300,000–340,000 ounces.

- We would be extremely frustrated to have bought the IPO only to see this huge downgrade within a month of listing.

In addition to the guidance cut, investor sentiment was further hit due to concerns around the company’s recent acquisition of the Telfer gold mine and Havieron project, notably the potential remediation costs tied to the ageing Telfer asset.

The share registry looks solid from Andrew Forests 16.5% position to Newmont’s 9.95%, while the board have some skin the game owning ~5.86mn shares with some of them also linked to FMG.

- Newly listed stocks that downgrade very quickly is a red flag for us.