Hi Carl,

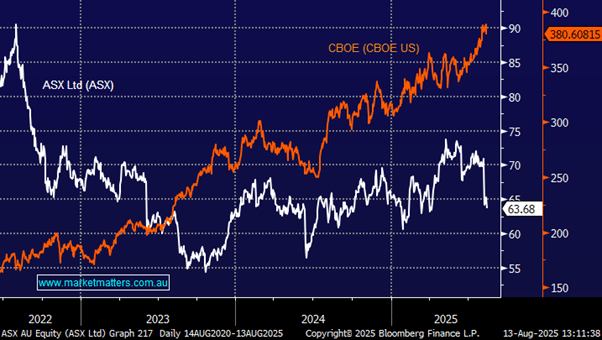

At this stage it’s unclear exactly what ASIC are likely to do but the ASX have proved on many occasions that they aren’t vaguely deserving on the monopoly they’ve enjoyed for decades. CBOE (the owners of Chi-X Australia) has been operating here since 2011, but on a smaller scale with limitations:

-

Cho-X already handles ~20% of trading volume in ASX-listed shares. Operates its own market data, trading systems, and clearing arrangements (though settlement still runs through ASX’s CHESS system—for now).

Moving forward ASIC is in the final stages of approving Cboe Australia’s application to operate as a full-fledged listing exchange, enabling it to host IPOs and direct listings—competing directly with ASX. Investors can already use Chi-X with most mainstream brokers who route trades to both ASX and Cboe, automatically seeking the best available price — this process happens behind the scenes.

If the ASX do not improve and evolve quickly they could be in real trouble as the Cboe is preparing to directly compete with ASX’s CHESS clearing and settlement system — a move that would significantly disrupt Australia’s post-trade infrastructure monopoly.