Hi Debbie,

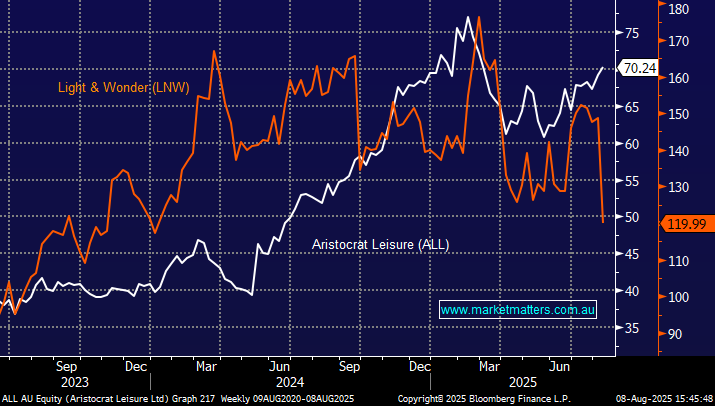

LNW plunged as much as 23% on Thursday, its biggest intra-day drop since COVID, after its revenue fell well short of expectations. Plus as you said they’ve decided to delist from the NASDAQ and focus on attracting funds from Australia’s large pool of super. It makes little difference to Las Vegas-based LNW’s business of selling poker machines and gaming software whether it is listed in the US or Australia, however the board thinks the move could be beneficial to the share price. It makes 70% of its revenue in the US, but capital is portable.

- Revenue of $809mn missed the $851.9mn estimate.

- Gaming revenue of $528mn, missed $568.8mn estimates, i.e. by 7.7%.

- Adjusted EBITDA of $352mn fell short of $349.6mn estimate.

When a growth company fails to grow at the rates expected by the market, the reaction is always very negative. We also don’t like it when a company focusses on where they are listed as a reason/excuse for the share price, or an opportunity to imporve it – seems a bit of a cop out.

No doubt the impact of macroeconomic uncertainty during the quarter led to more cautious purchasing behaviour and delayed capital expenditure amongst some of its customers – this makes sense. However, their gaming businesses still sold over 9000 new units globally maintaining its market share gains. Downgrades followed the update dragging the share price along for the ride.

- We are in no hurry own LNW just yet until we see some imporvingn trends. It’s ‘relatively’ cheap vs competitors but feels like it could get cheaper having fallen another 11% on Friday.