Treasury Wine (TWE), Lynas (LYC) and Hybrids

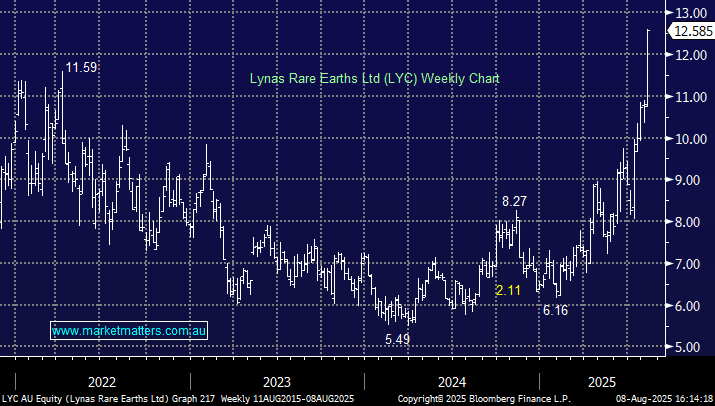

Hi Shawn Three brief questions in 1 if I may . 1. TWE wondering whether you could comment on the thought that TWE should be advantaged going forward by Trumps tariffs especially as they have a US domestic arm and Australian products will have a significant tariff advantage over other imports esp. European, -will this in your opinion lead to an improved performance in TWE from here? 2. Lynas are shooting the lights out at the moment; would this be a situation of "sell the strength" approach that you have been advocating for other stocks or better to enjoy the ride at this point ? 3. Following the maxim that there are no dumb questions - can you please clarify that when reading the hybrid chart that the score of "trading margin versus fair margin" should be interpreted as; the higher the figure ie .52% the lower the relative attractiveness of the value and vice versa- and would this be (all other things being equal ie: length of time to maturity and security of the backing company etc) be the main consideration when deciding in relative terms which one to purchase ? (In other words ..how to interpret these figures provided) Many thanks as always for your excellent product. Don