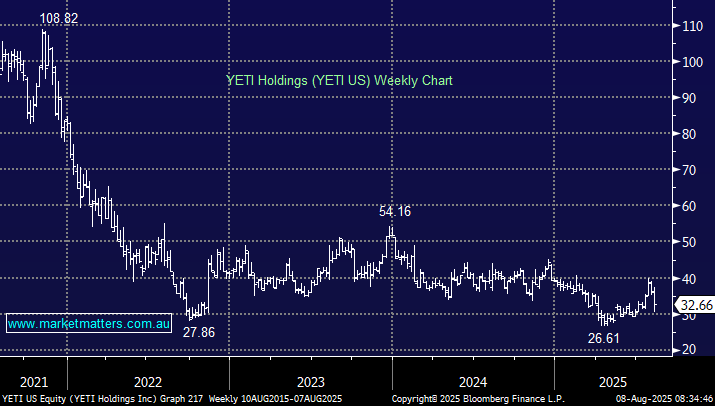

The drinkware and cooler maker reported quarterly results that were a bit of a mixed bag. A miss at the sales line but less impact from tariffs helped earnings beat. Guidance was for a similar trend to continue:

- 2Q sales of $445.9 million, -3.8% y/y, estimate $462.5 million (-3.5%)

- 2Q adjusted EPS 66c vs. 70c y/y, estimate 55c (20% beat)

- Wholesale sales $197.3 million, -7.4% y/y, estimate $212.6 million

- Direct-to-consumer sales $248.6 million, -0.7% y/y, estimate $251.4 million

- Coolers & Equipment sales +$200.6 million, -2.6% y/y, estimate +$217.5 million

- Drinkware sales +$236.4 million, -4.1% y/y, estimate +$236.3 million

YETI had guided to weak earnings at their last update, impacted by tariffs, given that they manufacture overseas and import into the US. That has eased, which has had a positive impact on earnings, but the market has rightly focused on top-line sales, which were lower than expected, and their guidance for the FY was downgraded a tad – now expecting sales growth of flat to up 2% vs 1-4% prior. The issue is primarily US drinkware sales, which are taking longer to recover. Internationally, they are going well and still expect y/y growth of 15-20%.

- Overall, the market focused on the sales miss, which is right, with the stock down 10%. Importantly, YETI rallied 30% in the last month ahead of the result, which explains the 10% pullback relative to the ~3.5% sales miss.