Hi Matt,

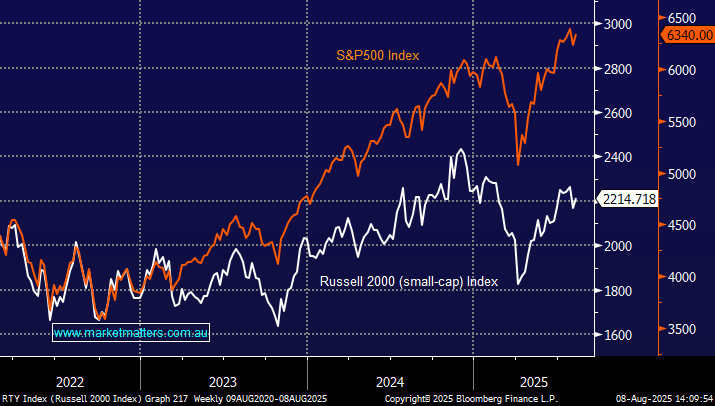

Almost wherever you look the large caps have outperformed small caps over recent years; the ASX the banks have led the charge for the large caps while in the US its been the Mag Seven/big tech stocks.

We do see some performance reversion, or catch-up, unfolding into Christmas as investors throw in the towel and consider the underperformers in attempt to find value – we’ve already witnessed it unfolding on the ASX with the banks and “Certainty Trade” passing the banner to the miners over recent weeks. Although we note no groups look particularly bad, its more a case of relativity.

- The anticipated lower interest rate environment should help the small caps as they tend to rely more on debt, especially in the US where in comparison many Big Tech stocks are sitting on mountains of cash.

- We would be more inclined to look towards the US as the Trump administration is pro business with tax cuts and deregulation coming through – the iShares Core S&P small-cap ETF (IJR) is an ideal vehicle.

- To stay local the BetaShares (SMLL) ETF is a good option and the VanEck (QSML) ETF for a more comprehensive international small-cap exposure.