Hi Ray,

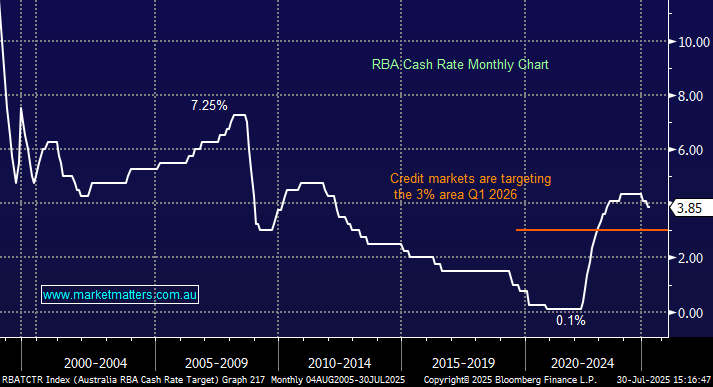

It’s a very good question and speaks to why asset prices of yield alternatives tend to rise when cash rates fall, investors look for alternatives, and there are plenty of options to consider, even when Bank Hybrids are being fazed out between now as 2032. Important to note that bank deposits are lowest risk, and everything else increases the risk to varying degrees. Here are some options we like for yield, outside of equities, in order of risk:

- Government bonds listed on the ASX: These are fixed rate treasury bonds (i.e. lending to the Australian Federal Government). They pay varying yields based on time to maturity, but can be bought and sold at any time on the ASX: The GSBG28 matures in 2028 and is paying 3.25% trading around $100 on Friday. Extending duration increases yield. At an extreme, buying the GSBK54 will pay 4.75% plus it’s trading at $98 so $2 worth of capital gain between now and 2054. Long duration means some more risk around changes in interest rates during that time frame, however, for now, if interest rates continue to fall, the bond price should rise and pays the 4.75% along the way. A full list of these are available on the ASX wesbite here: Bonds – prices

- Corporate credit either directly through a bond broker or via an ETF. In bespoke portfolio’s we manage (via James), we own bank subordinated debt, which is paying ~5.8% fixed for durations around 5 years. An ETF is a simpler alternative and we hold the CRED ETF in the Core ETF Portfolio, which provides exposure to a portfolio of senior, fixed-rate, investment‑grade Australian corporate bonds, yielding ~4.75%.

- Hybrids are still around until 2032 for major banks, and past that for any non-bank issuers like insurance companies and Macquarie. These are still an alternative. We own the SUNPI in the insurance space.

- Diversified Income Trusts such as the Dominion Income Trust (DN1) we own in the Income Portfolio. That invests in things like Residential Mortgage-Backed Securities, loans, trust interests, notes, bank facilities. Relatively low risk and targets RBA cash +3.25%, currently yielding over 7%. The Perpetual Income Trust (PCI) is an another similar alternative and so is the Gryphon Capital Income Trust (GCI) paying ~7.5%

- Private credit funds that pay over 8% – an example we hold is the MA Credit Income Trust (MA1) which targets Cash +4.25%. For wholesale investors, the options expand further into the unlisted area which has less liquidity, but higher yields as compensation.

When going outside of bank deposits for yield, best to diversify across various exposures, with different investments underpinning them.