Hi Manie,

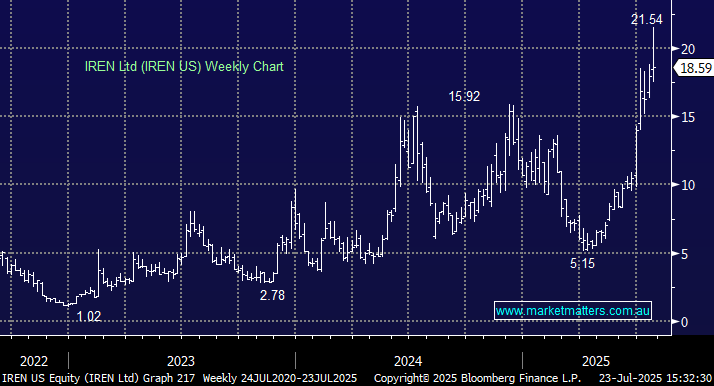

Sydney based, US-listed IREN Ltd (IREN US), has come up several times in Q&A’s, and at MM we took a small position at the end of last month, we wish all positions moved over +50% in our favour in a matter of weeks! However, the volatility of the stock is the reason we only took a 2.5% position, and we stick with this logic.

We continue to like IREN which we discussed in more detail in June prior to our purchase, initially indicating the stock was worth ~$US19 on 20x consensus earnings for FY26 hence after already spiking to $US21.50 this week, we can see your thoughts about buying or selling.

- IREN spiked up this week after EMJ Capital’s SOTP analysis projected $300/share intrinsic value. A ludicrous valuation in our opinion.

- The analysis triggered some institutional buying as the stock broke to new highs helped by Bitcoin’s rally towards $120K.

We like IREN story and at this stage we plan to let it run, with some consolidation likely after the stock’s recent surge higher. We are in hold mode currently, though would likely add to the position in the $US16-17 area, and would lighten the load in the mid $20’s. It could easily hold a higher multiple than 20x.