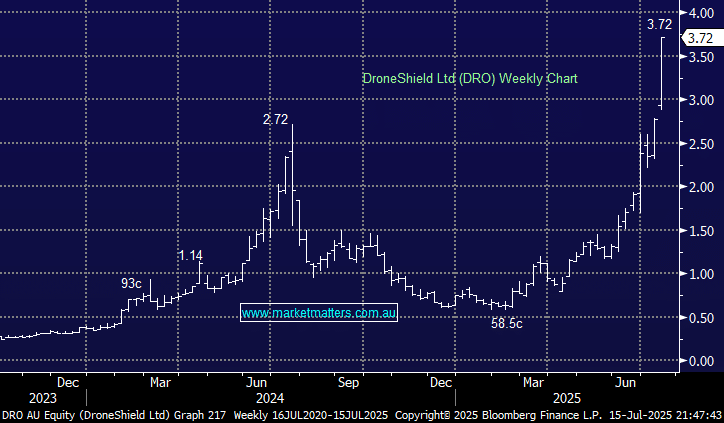

We’ve had DRO on the Hitlist for the Emerging Companies Portfolio since below $1, and the share price has gone berserk since, up 4x, which is frustrating. As a refresher, they develop and manufacture counter‑drone systems; technologies to detect, identify, and neutralise unauthorised drones using a mix of sensors, AI, and electronic warfare. They design and deliver both hardware and software, which includes detection devices like wearable sensors, radar and camera units, mitigation systems, which are essentially ‘jammers’ in various forms, then more integrated platforms that combine a bunch of these things.

- Drone warfare is the future, both in the sky and in the oceans, and DRO is in the right spot, at the right time.

The share price rally has pushed its market cap to $3.2bn, which equates to ~16x revenue (NB revenue, not profit!). This is exceptionally expensive; however, they have been winning contracts with influential customers, validating their solution, and they should actually turn a profit this year – something in the order of $30-40m (Dec year-end). That said, if the opportunity is significant, it requires capital. They have cash on their balance sheet, however after a such a strong run in the shares, raising some more could be high on their agenda.

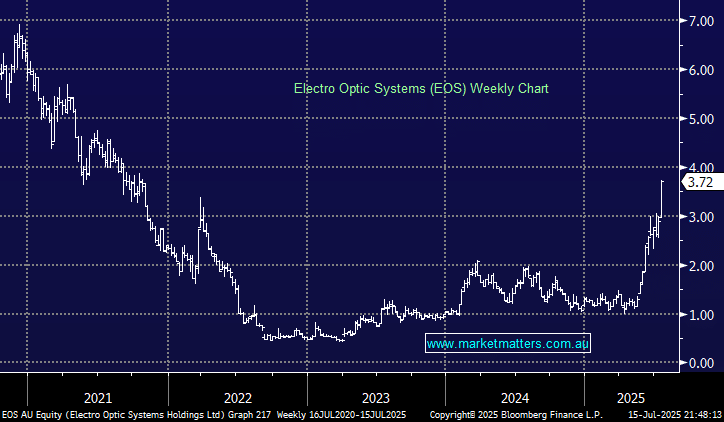

Electro Optic Solutions (EOS) is another smaller player in the space, with a market capitalisation at a more modest $720m, even after the shares have nearly gone up 4x. They’ve been operating since 1983, listed on the ASX in 2002, and have a chequered history, but they also find themselves in a hot sector at a time when their technology is experiencing a significant uplift in demand. They have contracts with the ADF, European Naval Forces and the US military for their solutions that include remote weapon stations, counter-uncrewed aerial systems, high-energy lasers, and space domain awareness gear.

- They have burned through plenty of capital over the years, and while they are not profitable, the landscape for this sort of technology has experienced a step change in recent times.

Both EOS & DRO are very hard to value, if not impossible, and we expect a high degree of sentiment-driven swings in their respective share prices from here. Could we chase them at $3.70? Probably not, but we would have said the same at half the price. It’s not often that a sector attracts so much attention and rallies so aggressively in such a short window, and we, no doubt, like some of you, are feeling left out.