Hi Trish,

When we think about yield stocks, there are three key components we consider:

- The yield itself: In the case of TLC, this is ~3% fully franked, which is below the yield of the broader market which sits at ~3.5%

- How predictable or defensive the earnings are that underpin the dividend, looking for stable earnings that feed into the same characterics in the dividend. In the case of TLC, earnings are fairly stable, defensive and quite predictable over time.

- Dividend growth which is predicated on earnings growth and a stable payout ratio. There is moderate dividend growth predicted for TLC in the coming years , in the mid single digits, but not too exciting.

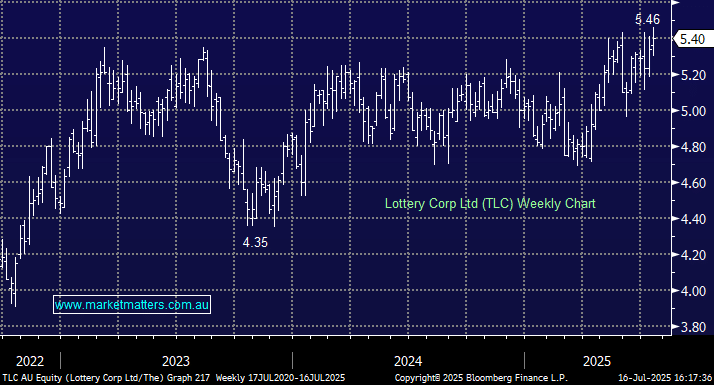

Overlay this with valuation, and in the case of TLC, it’s trading on the expensive side. With the “Big Four banks” offering term deposits with higher returns, TLC is not a compelling stock from an income perspective, and it’s valuation is not attractive at current levels. We are not interested in TLC at $5.40

- TLC is more of a defensive option for when equities correct, but we are not keen on it for now.