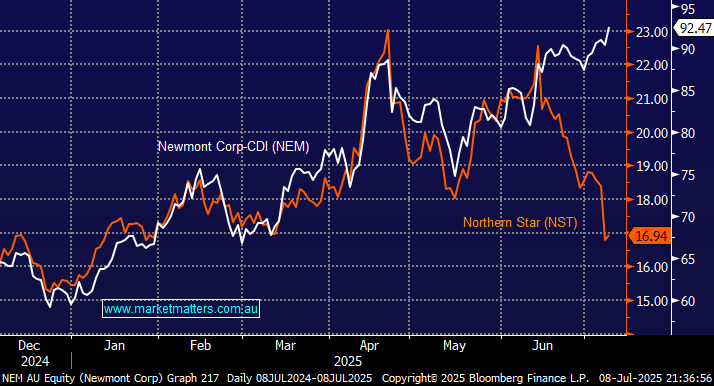

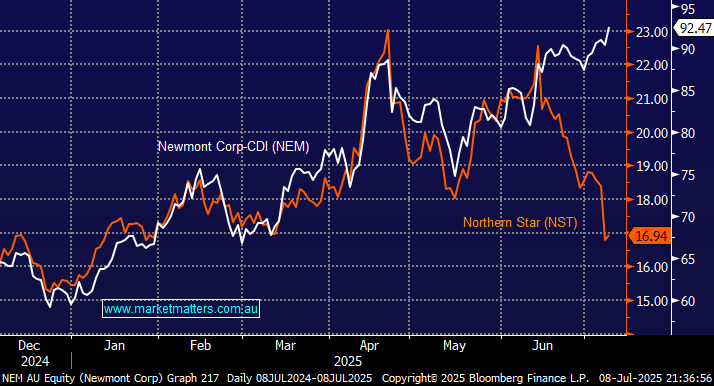

We chose to look at NEM this morning due to the dramatic underperformance by the Australian gold miners in recent weeks, which has been hard to reconcile on the surface. Our timing couldn’t have been better after Goldman downgraded NEM to a hold overnight, on valuation grounds, following the gold miners’ record run – the stock closed down more than 4% in the US:

- In recent months, Gold has slipped ~5% in $US terms, and 6.5% in $A terms, from its April high. I.e. there has been nothing dramatic on the currency front.

- US miners: Before last night’s pullback, Newmont (NEM US) and Barrick (B US) had advanced 16% and 11% respectively from their respective June lows

- Australian miners: From their June highs, the ASX tells a very different story, with Evolution (EVN) correcting 24.5%, Regis Resources (RRL) 23%, and Northern Star (NST) 29%.

With the world’s largest listed gold producer, Newmont, now listed on the ASX following its takeover of local heavyweight Newcrest Mining (NCM), we must question if/why MM should consider the US gold producer over our own after its dramatic outperformance in recent weeks. The story is more balanced across Canadian miners as their performance has been closely related to the underlying gold price, outperforming ASX miners but underperforming their US peers. Hence, to increase our gold exposure across the MM portfolios, we must first ask what’s wrong with the local names? Should we instead be focusing on the US goliath?

We believe the momentum trade unwound locally. Australians love the gold sector, and with talk of ever-higher bullion prices regularly featured in the press, buying of the local sector became almost frenzied. Hence, when any less positive news came out, whether a weaker gold price, an analyst downgrade on valuation concerns, or production issues, the unwind of the crowded positioning was dramatic. The most obvious example being Northern Star (NST), with stock fully priced, and some before hitting a few speed humps:

- UBS downgraded EVN to a sell in late June with a $6.70 price target (PT), while yesterday saw Goldman downgrade EVN to a sell with $6.95 PT – a bit late by GS with EVN 20% higher a few weeks ago.

- This week, NST sold off on weaker production and downgrades followed across the board: GS PT was $19.50, but most are still way above $20.

We remain bullish on ASX gold miners into further weakness, finding Goldman’s “late” downgrade encouraging overnight. If it drives stocks lower in the coming week, MM is likely to fade the move as we feel the local unwind is maturing fast. We continue to like EVN and Regis Resources around 6-8% lower and plan to increase our Active Growth Portfolios position in EVN on a move nearer $7. At the same time, the more volatile RRL is a candidate for our Emerging Companies Portfolio.

- We believe the US gold miners’ outperformance over the ASX names is mature, if not over.

Newmont which trades in the US under the code NEM US, to put things into perspective it has a market cap of over 4x that of Northern Star (NST). While NEM trades on the ASX it’s predominantly a US stock where they aren’t as passionate about the gold sector as we are in Australia, why would they having an incredible tech sector! The point being they didn’t have a huge, crowded gold position waiting to unwind at the slightest sniff of weakness.

Gold stocks endured a tough session in the US overnight, with the 28-member S&P/TSX Gold Index retreating 5.4% at its worst, with every stock falling. However, heavyweight NEM caught the headlines and weighed on sentiment after Goldman cut the stock to neutral on valuation grounds. We believe this sharp pullback will provide a buying opportunity in the gold sector – watch for alerts more broadly, though NEM is not our preferred option.

- We don’t mind the risk/reward towards NEM back around last week’s lows, but we see better risk/reward in its ASX peers.