Hi Deb,

Good question, not “all cats” can be equal.

The ETF portfolio is designed to be fully invested, where we upweight and downweight specific asset classes (via ETFs). We do have some tweaks coming around this portfolio following EOFY.

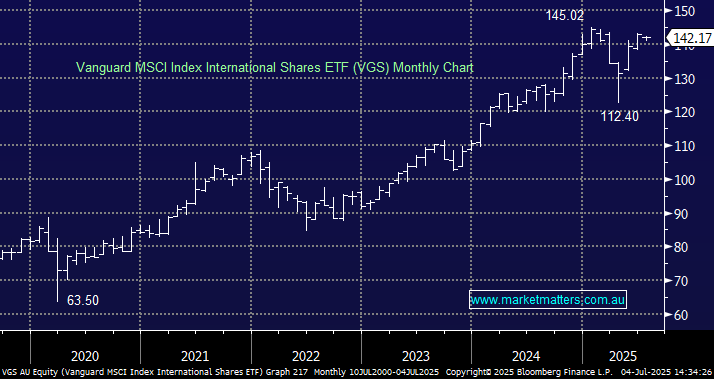

- Over the coming months we like the Vanguard MSCI Index International Shares ETF (VGS) for an ongoing push to new highs in line with our bullish view towards stocks.

- Into further weakness we would opt for the Global X Physical Gold (GOLD) ETF.

- We think small caps can start to outperform.

- We are likely to mildly increase risk towards fixed income by holding a higher proportion of corporate credit (bank bonds) vs government bonds.

Short-term “Shawn’s Trade Ideas” is likely to look at some ETFs in the resources space on Monday.