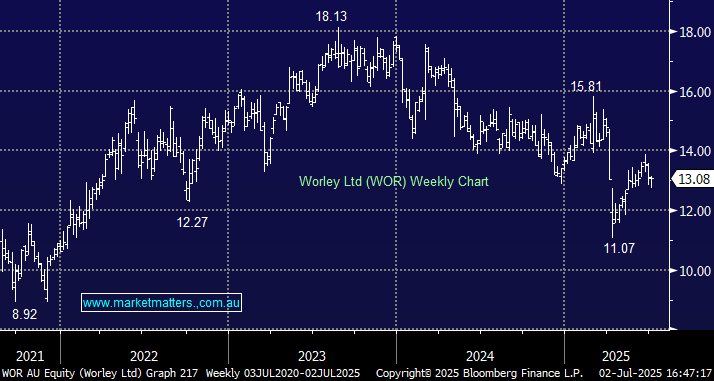

We thought WOR was back on track in February when it delivered a very solid 1H result plus a supportive $500mn buyback, but that has not transpired with the stock retreating 30% after its initial rally. As we said in late June in the last Q&A of the month, we still like WOR despite concerns over the sustainability of its project pipeline and it being linked to corruption around its involvement in the Pacific Refinery Project, in Ecuador, dating back to 2011 and 2017 (i.e. this is old news). On Tuesday, a large seller unloaded a block of $92.3m worth of shares that traded at a 3.4% discount; this feels like the end of a sell order with the stock trading higher since – interestingly, this is one stock that’s struggling to regain the lost ground in April.

- We are still targeting a test of $16 over the coming year: MM holds WOR in our Active Growth Portfolio.