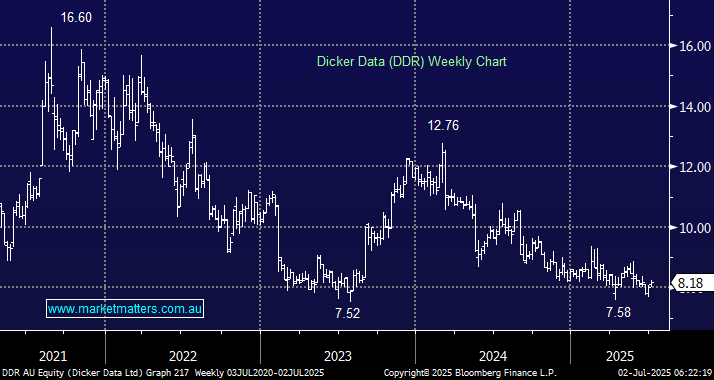

We put DDR on the Income Hit List about 6 weeks ago, when it was trading ~$8.70. The stock has pulled back since following the retirement of Co-Founder, CEO and Chairman David Dicker. We continue to believe DDR offers an attractive combination of mild growth (~10%), strong yield (~5.5%) and a catalyst from an AI-driven technology refresh from Australian SME’s. Our original thesis can be revisited here. DDR has 7 buys and 1 hold across analyst coverage, with a consensus price target of $10.18.

- In the low $8’s, the risk/reward has clearly improved, and DDR remains on our radar for the Active Income Portfolio.