This morning’s review of RHC is well-timed after the stock’s 2.3% gain on Tuesday and the rotation out of tech into healthcare in the US overnight: Amgen (AMGN US) and United Health (UNH US) jumped more than 4%, while Merck (MRK US) and Johnson and Johnson (JNJ US) rose more than 3% and about 2%, respectively, lifting the Dow in the process. As investors search for value, healthcare is likely to be at least considered, with the sector the worst performer in 2025, currently down 7.4% compared to the underlying ASX200, which has gained almost 5%. Our Active Growth Portfolio has been devoid of the struggling sector this year, but as rotation looks set to be the dominating theme through the 2H, we are now seeing value in some pockets of this important sector.

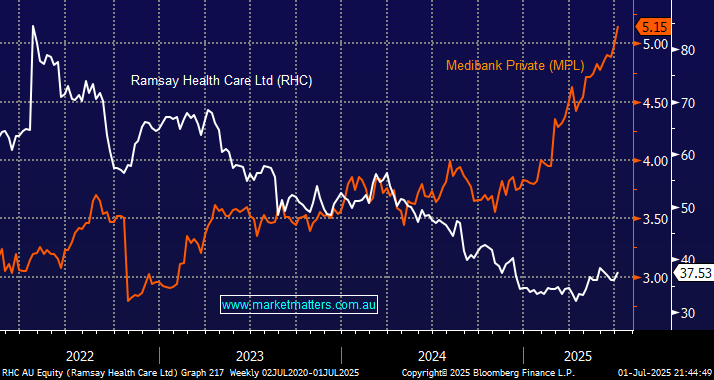

- A quick look at high-flying healthcare insurer Medibank Private (MPL) compared to Ramsay Healthcare (RHC) illustrates whose been the big winner over the last few years:

Private hospitals have been hit by a perfect storm of global inflation, labour shortages, payer constraints, and shifting patient demand, particularly in Europe and the UK. In Australia and Europe, private insurers have been slow to approve or fully pass on hospital cost increases, illustrating who’s been driving the train. While government initiatives like elective surgery funding and insurance incentives have supported RHC, other decisions, such as the recent ban on public-private partnerships (PPPs) in NSW for acute care hospitals, and limited engagement with private hospitals in policy discussions, have introduced challenges.

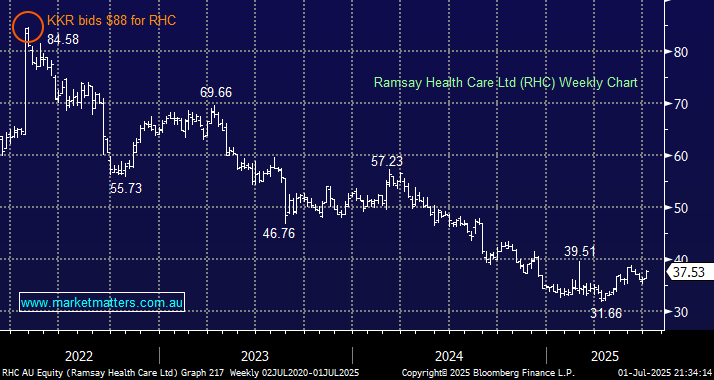

The obvious question is how much of this bad news is built into the once market darlings’ share price after its more than 50% decline from its 2022 high:

- RHC is expected to make around $290m net profit in FY25, which is an incredibly low number for the size of the business, though at least they’re muddling through making money, even in tough times.

- The company continues to focus on its considerable debt load, particularly in its European operations. The potential sale of a portion of its stake in French “problem child” Ramsay Santé would be a catalyst for a rally by RHC.

- RHC is trading on the cheap side from a historical perspective, but that’s no surprise considering recent years.

Private hospitals are required to reduce the strain on public hospitals and to offer specialist elective surgeries. However, tight government regulation and cost constraints to ensure universal access and equity are bad news for any business or sector. Conversely, we believe the industry is at or close to its nadir, with the government balancing funding between public hospital capacity and private healthcare support to improve system efficiency and patient choice. Also, programs like Surgery Connect in Queensland, allocating funds to private hospitals to reduce public hospital waiting lists, could be a sign of things to come.

- We believe the impressive outperformance by MPL versus RHC is maturing.

Back in February RHC reported better than expected revenue but news that it had hired Goldmans to explore strategic options for its shareholding in Ramsay Santé, which garnered the most attention – RHC hold a 52.79% stake in Paris based French healthcare operator Ramsay Santé which reported a net loss of €19.8 million for the year. Interestingly, RHC appointed Craig Drummond as a non-executive director in May, the same person who positioned MPL for its recent impressive gains, having been CEO from 2016-2021, an astute operator (Shawn says), who worked with him at JB Were/Goldman Sachs back in the day.

There has been no news so far on the sale of all or part of its stake in Ramsay Santé, but even without this proverbial shot in the arm, we believe markets have become too negative towards both RHC and its French holding. Constantly bad news will do that!

- We like the risk/reward towards RHC around $37.50: MM is adding RHC to its Hitlist.