Hi Peter,

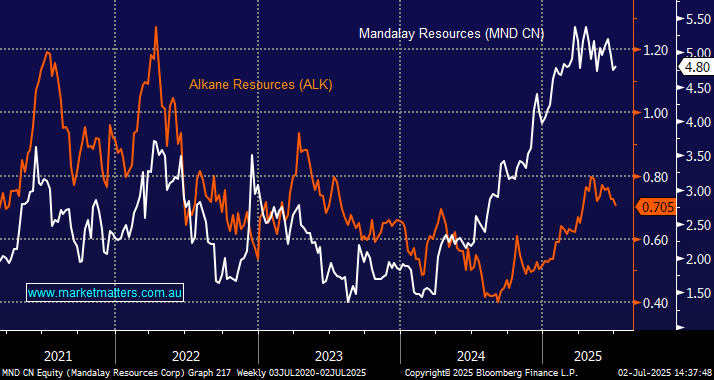

We understand your scepticism with this $430mn gold producer/explorer whose managed to fall while its peers have soared over the last few years. For subscribers not familiar with Alkane (ALK) and Canadian based $C454mn Mandalay (MND CN):

- ALK and MND have announced a “merger of equals” to form a diversified gold and antimony producer operating under the Alkane Resources name.

- MND shareholders will receive 7.875 ALK shares for each MND shares held, resulting in approximately 55% ownership for MND shareholders and 45% for ALK shareholders in the merged company.

At the end of Q1 the combined company has a pro forma cash balance of A$188 million (C$167 million) and no debt, with the ASX listed company also planning to pursue a secondary listing on the Toronto Stock Exchange (TSX). We are with you, ALK looks to be the main beneficiary at this stage:

- Both companies are profitable, but ALK has a higher full-year profit so far, while Mandalay’s growth is accelerating rapidly based on Q1 FY25.

- Mandalay has a lower AISC (gold production cost), indicating more cost-efficient production at present.

We believe the new ALK should be an improved version but the share price tells us people close to the businesses aren’t convinced. Consolidation does make sense.