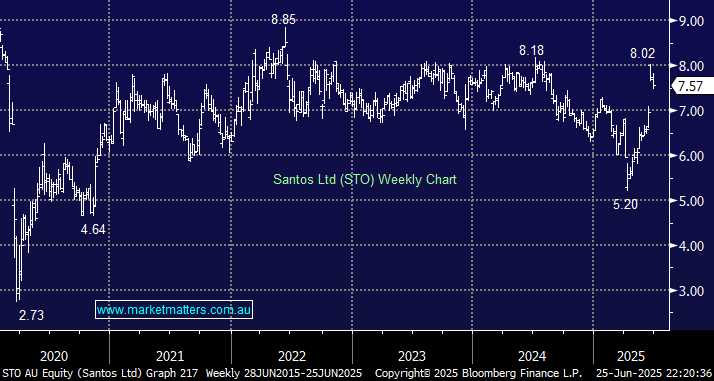

STO has received a bid from Abu Dhabi National Oil (ADNOC), equivalent to $8.89/sh. The more MM reads about the offer, the greater the possibility that it might receive FIRB approval. The suitor has brought in heavyweight Labor-aligned lobbyists as it attempts to smooth the way for its proposed $36.4 billion purchase of STO. Most M&A deals have ultimately “fallen over” since COVID-19 because buyers have walked away for various reasons. However, ADNOC appears committed, having made two prior bids at lower prices before gaining the boards support on the 3rd. We believe it will proceed if the FIRB gives it the green light and/or if the conditions are not too onerous.

- We like the risk/reward for STO around $7.50 with an estimated downside of ~60c, providing decent risk/reward compared to the 130c takeover upside.