This time last week, we discussed copper alternatives across the ASX and ultimately elected to reduce our position in Sandfire (SFR), and increase our position in BHP Group (BHP). The key takeaways last week were:

- MM remains bullish toward copper (Cu) with it being instrumental in global electrification, from AI to EVs and the overall push toward a zero-carbon footprint.

- Sandfire (SFR) is looking increasingly rich compared to the Cu price, as it trades close to its all-time high, but we don’t want to lose our copper exposure.

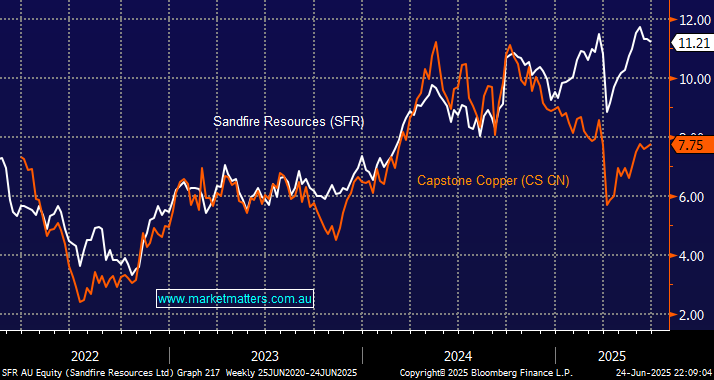

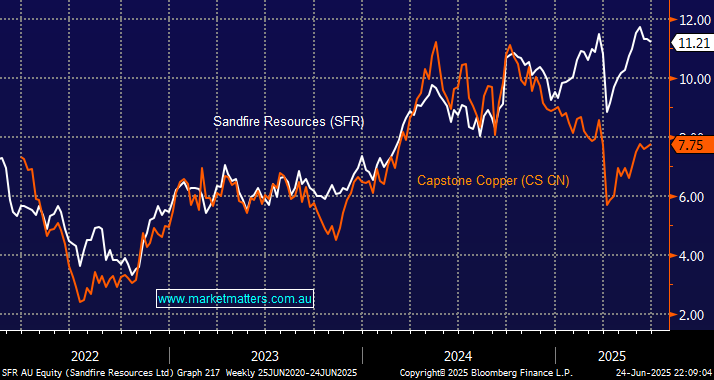

Last week, we briefly mentioned Capstone Copper-CDI (CSC), the $CAD6 billion Canadian copper miner, which remains ~30% below its 2025 high. With the stock trading on the ASX since April last year, we have a viable alternative to SFR, something that’s been lacking since BHP took out OZ Minerals (OZL). The last few days have seen CSC slightly outperforming, with the relative moves over the previous few years certainly suggesting it’s worth considering a switch. Capstone Copper has faced several challenges over the past year, despite achieving record copper production in 2024. The question is whether we believe they can improve things in the coming years:

- Their Mantos Blancos mine in Chile (25% of revenue) experienced a decline in oxide production due to lower dump throughput, grade, and recoveries.

- The ramp-up of the Mantoverde mine, also in Chile (30% of revenue) led to higher operational costs, but CSC expects this to improve moving forward.

Capstone Copper has provided guidance for 2025, forecasting copper production volumes between 220,000 and 255,000 tonnes, representing an increase of between 19% to 38% compared to 2024. Additionally, the company anticipates a decrease in cash costs of between $2.20 and $2.50 per payable pound of copper, which is approximately 10% to 20% lower than in 2024 – some big spreads here but all in the right direction. In the first quarter of 25, Capstone Copper reported record revenue of $US533.32 million, marking a ~57% increase compared to the same period in 2024.

We believe that CSC has significant upside potential from its current level, but the market is not fully embracing the potential operational turnaround. In FY24, Capstone Copper (CSC) revenue was $US1.6bn, which is projected to hit $US2.6bn in FY26, up over 60%, significantly increasing earnings in the process. In comparison, SFR revenue in FY24 was $US935mn, which is expected to reach $US1.3bn in 2026, up ~40%.

- We feel the risk/reward is starting to favour CSC over SFR after its recent underperformance.

We have been discussing the overcrowded gold position for a few weeks and specifically when a washout might afford us the opportunity to increase our exposure to the sector. One of the main triggers we’ve been looking for is when ASX names hold up/rally in the face of a weak gold price and we saw that on Tuesday with gold falling over $US50/oz while Evolution Mining (EVN) ended up and Regis Resources (RRL) was flat. The respective moves across the space over recent months make interesting reading:

- Gold is trading 5% below its April high, whereas EVN is 21% below its recent high and Regis Resources (RRL) is 17% below its equivalent milestone.

We are confident that both EVN and RRL are approaching good buying levels, although a few more per cent wouldn’t surprise. We’ve mentioned RRL as it’s on our radar for the Emerging Companies Portfolio, with the $4.50 area a good area to start accumulating a position.

- We believe that, around current levels, EVN is offering solid risk/reward as gold loses its lustre.