Hi Simon,

The Japanese bond market and macro-economic backdrop is a fascinating tale:

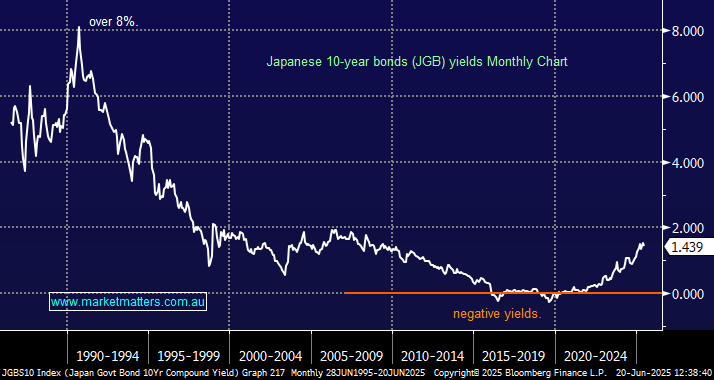

- With a declining population and sluggish economy, at best, the Bank of Japan (BOJ) has fought valiantly to reinvigorate growth, including having a negative Cash Rate of -0.1% between 2016 and 2024 – negative yields is a hard backdrop to comprehend.

- These low rates led to investors borrowing money in Japan and investing overseas to effectively get free interest (arbitrage) a trade known as the “Carry Trade”, e.g. If Japan’s interest rate is 0% and the U.S. offers 5%, the investor earns a 5% return (minus any costs).

- Last July/August this very crowded space which was squeezed/ unwound dramatically when the BOJ unexpectedly raised its benchmark rate to 0.25%, reducing the appeal of borrowing Yen at ultra-low rates.

The BOJ is attempting to raise interest rates because Japan is finally seeing inflation and wage growth after decades of low, or declining prices. After many years of deflation in 2022–2023, inflation picked up due to higher global energy prices, a weaker yen, and stronger domestic demand. Hence the BOJ is trying to slowly normalise rates – there’s nothing normal about negative rates and the current 0.5% would still be the envy of Australian mortgage holders.

The BOJ is acting on two fronts, it’s winding down its massive bond-buying program. To avoid disrupting markets (especially for long-term debt), it’s asking investors what kinds of bonds they’d prefer and how to keep demand strong before making changes.

- The BOJ previously bought huge amounts of Japanese Government Bonds (JGBs) to keep interest rates low and stimulate the economy, this action is no longer required.

- The BOJ owns nearly half of all Japanese government bonds, they want to wind down purchases to create a healthier, more balanced bond market with more participation from banks, insurers, and pension funds – far easier to achieve with decent rates on offer, and a potentially appreciating currency.

Japan is the largest single foreign holder of US debt, holding around 13%. If BOJ keeps raising rates albeit from very low levels, and the Yen follows suit, US bonds become less attractive which could ultimately cause issues for the US.