Hi Ian,

In terms of coal, Whitehaven (WHC) is our preferred option. We view it as underpriced after they’ve transformed their business into a primarily Met. coal business. CRN needs to fix up the balance sheet , though we may revisit in the new FY.

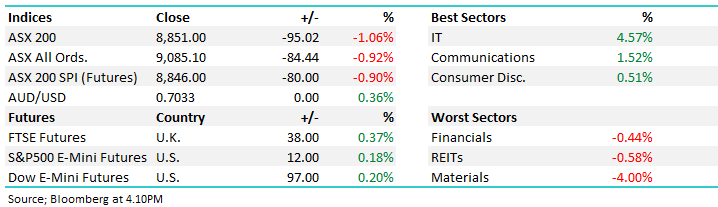

The REITS’s should go well assuming the RBA does cut rates three times in 2025, but with the real estate sector outperforming slightly in 2025 advancing over 6% in 2025 some of this backdrop is already built into the sector.

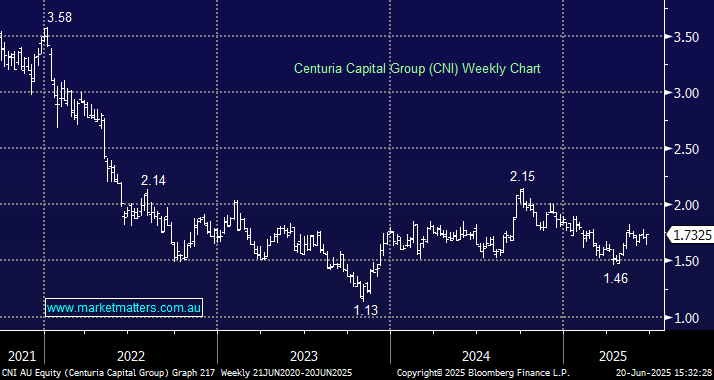

- Centuria Capital Group (CNI): we hold CNI in our Active Income Portfolio for its more than 6% part franked yield and potential for capital growth, as with rates set to fall this the property fund manager is one REIT we particularly like.

- Dexus(DXS): We discussed DXS in May, its forecast to yield ~5.3% part franked over the next 12-months, not as good as CNI and the share might be starting to reflect this. However, we like its exposure to high-grade office space, which is starting to turn, and we remain positive ~$7.