Your opinion on 3 stocks please

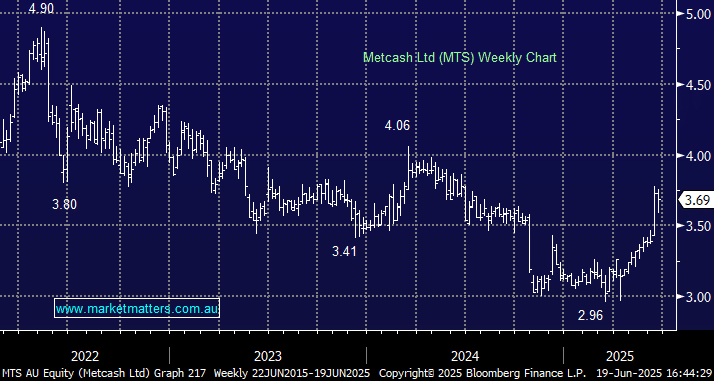

Dear Team, I am over 80 years of age. Therefore I must take 7% out of my super in pension every year. It is nearly impossible to cover this amount with dividends alone without reducing my small bundle. I am sure I am NOT the only member of MM that is in this nefarious position. Hence, I constantly look for high yield stocks with some growth. Recently I have had considerable success with TLS and others. However, as the stock rises handsomely; the % yield drops. Therefore I must move on if I am not to go backwards. You have MTS in your income portfolio. It attracts me , but, like small banks , when the going gets tough the smaller players get hurt. I did well out of BOQ until it went pear shaped. I fear MTS might go the same way. What are your comments? You have DDR on your hit list. It has gone backwards quite a bit and yet you have not 'pulled the trigger'. In what circumstances will you act on buying this stock? You have said that below $8,00 TWE will have ' Deep Value'. It has been below $8.00 and yet you have not bought it ( again) . Is the risk too great ? I apologize for asking about 3 stocks. That is the reason I gave the long winded introduction before asking the questions. I suspect many other MM members who are in the same boat as I am will benefit from your comments even as I no doubt will. Thank you once again for your superb service. Octogenarian